Advertisement

Advertisement

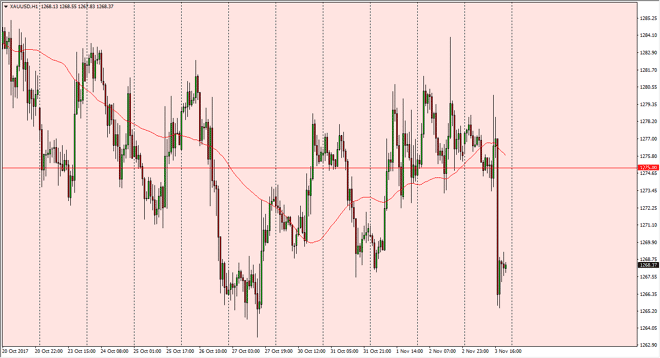

Gold Price Forecast November 6, 2017, Technical Analysis

Updated: Nov 4, 2017, 06:08 GMT+00:00

The gold markets initially hovered above the $1275 level, an area that has been important for some time. The market going back and forth suggests that the

The gold markets initially hovered above the $1275 level, an area that has been important for some time. The market going back and forth suggests that the uncertainty in the interest rate future for the United States continues, as the Federal Reserve looks likely to raise interest rates, but quite frankly most of the normal metrics that gold traders will use are less than impressive. There is a serious lack of inflationary pressure, so I think that there is a lot of “wait and see” trading going on. Longer-term charts suggest that if we pull back to the $1250 level, it’s likely that we will bounce and continue to go higher. Quite frankly, I want to see a pullback as an opportunity to buy this market, because that would confirm an uptrend in channel on the weekly chart. It does look like were trying to roll over here, so being patient might be the best way to go forward.

Alternately, if we break above the $1275 level, it’s probably going to be yet another selling opportunity. We’ve seen more than enough noise near the $1280 level to keep the market down, and I think we may need to establish a bit more value to get people excited. If the US dollar can roll over, the gold market should continue to go much higher at that point. I believe that the currency situation continues to have a major influence in the precious metals markets, and gold of course won’t be any different. If we were to break above the $1300 level, the market should then continue to go even higher, perhaps the $1325 level as it has been important in the past, and it should continue to be important in the future. Volatility continues, but value is something that I think we are going to go looking for.

Gold Price Forecast Video 06.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement