Advertisement

Advertisement

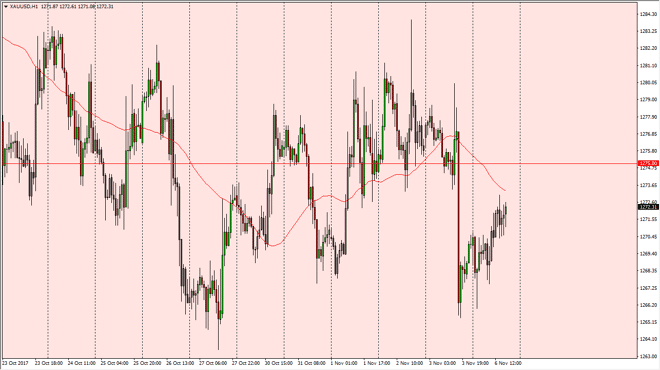

Gold Price Forecast November 7, 2017, Technical Analysis

Updated: Nov 7, 2017, 07:01 GMT+00:00

The gold markets have rallied again during the trading session on Monday, which of course makes sense as the Saudi purge took headlines over the weekend.

The gold markets have rallied again during the trading session on Monday, which of course makes sense as the Saudi purge took headlines over the weekend. This has people bit nervous, and it looks as if we are going to go looking towards the $1275 level, an area that continues to offer resistance. However, even if we break above there think there’s plenty of resistance near the $1280 level, so I’m looking to sell gold at the first signs of exhaustion. This will be especially true if the US dollar starts to rally in a bit of a “risk off” move, so it’s ultimately that I am a seller in the short term.

I have no interest whatsoever in trying to buy this market until we get above the $1300 level on a daily close. Once we get that moved, then I think it becomes more of a buy-and-hold situation, but I don’t see that happening in the short term. Quite frankly, gold doesn’t look very strong these days, as massive turn around and bullish pressure seems to be rolled over just as quickly as it comes. Beyond that, people are starting to use crypto currencies in the place of gold, as a bit of a store of value. I don’t necessarily agree with this, but right now that is the trend and of course it has caused a bit of trouble in the precious metals sector.

I would wait for a confirmed roll over and the price action before it would be a seller, but buying at this point is can be difficult because of the massive amount of noise above. At this point, I just don’t have any interest in trying to fight through the noise that I see above.

Gold Price Video 07.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement