Advertisement

Advertisement

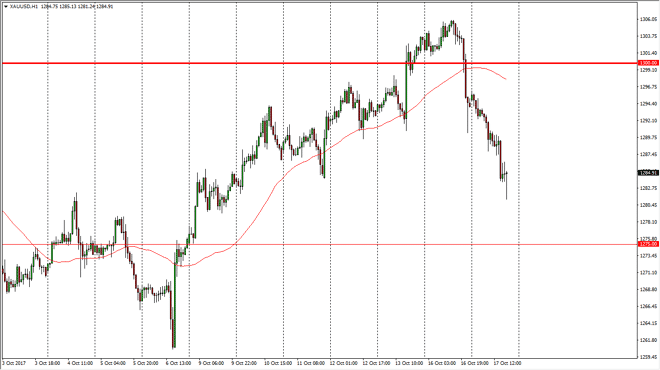

Gold Price Forecast October 18, 2017, Technical Analysis

Updated: Oct 18, 2017, 04:54 GMT+00:00

Gold markets initially fell during the day on Tuesday, slicing through the $1285 level. This is a very negative sign obviously, and I think that although

Gold markets initially fell during the day on Tuesday, slicing through the $1285 level. This is a very negative sign obviously, and I think that although we are starting to see a little bit of support, bearish pressure is probably going to continue. I recognize that the $1275 level underneath will probably be even more supportive, so I think the downside damages mostly done at this point. Having said that, I would not jump back into this market place until we get some type of supportive daily candle, as the gold markets have been hit rather hard. Remember that the $1300 level is important, and the fact that it has turned out to be rather resistive and resilient with that selling pressure suggests that we could continue to see a lot of noise in this market.

Precious metals have been getting hit due to lack of clarity with the Federal Reserve, and that being the case it’s likely that we will continue to see choppiness a major problem. I think that small position sizing is probably the best way to go forward, but if we were to break down below the $1275 level, it’s likely that we will see an acceleration to the downside, and therefore I would become a bit more aggressive on the short side. Ultimately, this is a market that is likely to find buyers, but we need some type of catalyst, be it a US dollar falling in general, or perhaps some type of geopolitical headline crossing the wires. Until then, I think we are going to struggle to have any significant move to the upside that has consistency. Back and forth choppiness is probably the likeliest of outcomes in the next week or so as the noise continues.

Gold Price Video 18.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement