Advertisement

Advertisement

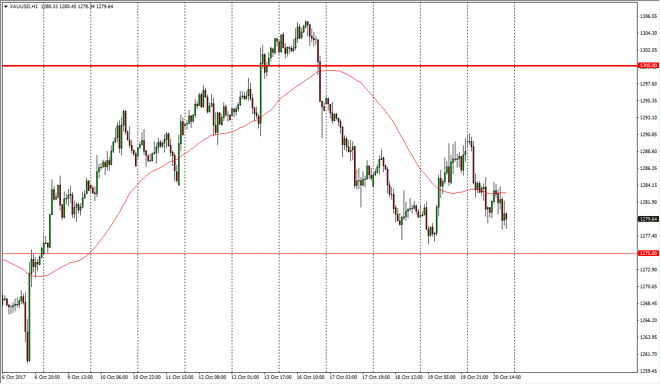

Gold Price Forecast October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:16 GMT+00:00

Gold markets fell significantly during the day on Friday, reaching down towards the $1278 level. We found a little bit of support there though, and I

Gold markets fell significantly during the day on Friday, reaching down towards the $1278 level. We found a little bit of support there though, and I think that the support extends down to the $1275 level. If we break down below there, a short-term selling opportunity to the $1250 level would be possible, just as a bounce from this area could send this market to the $1290 level. A break above there could send the market to the $1300 level, but quite frankly I think the gold is going to struggle as the Federal Reserve Chairman will more than likely be hawkish, and that should send interest rates in America higher. By extension, that should send the value the US dollar higher, which works against gold overall. However, if we do rally from here and break above the $1290 level, we could very well have just formed a “W pattern” on the hourly chart. It’s a very choppy market, and that being the case I think it’s can be difficult to hang on to the gold market.

On a break above the $1305 level, this is a market that should take off to the upside, that would be a significant break out, and assigned the gold was ready to pick up momentum yet again. Ultimately, this is a market that continues to be very noisy, and I think that short-term trading is probably about as good as it gets. If you can scalp the gold market, you may pick up a few winning trades from time to time, but ultimately, it’s going to be very difficult to hang onto a trade for any length of time, as gold is likely to be knocked around by headlines coming out of Washington DC and of course the bond markets.

Gold Prices Video 23.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement