Advertisement

Advertisement

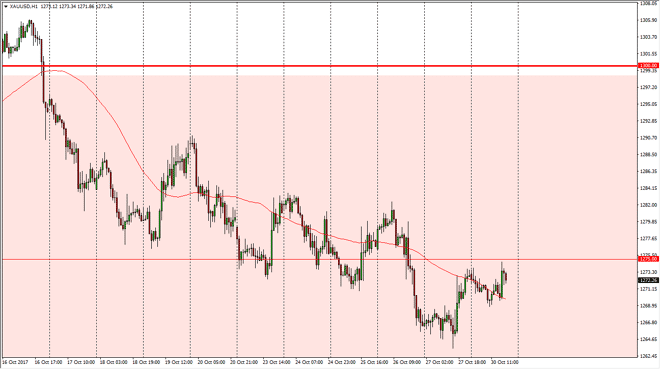

Gold Price Forecast October 31, 2017, Technical Analysis

Updated: Oct 31, 2017, 05:22 GMT+00:00

Gold markets were volatile during the Monday session, initially falling but then finding enough support near the $1269 level to turn around and break

Gold markets were volatile during the Monday session, initially falling but then finding enough support near the $1269 level to turn around and break towards the $1275 level again. This is an area that continues to be important for both sides of the equation, so I think it is probably best to step aside. In fact, I’m waiting for the market to tell me which direction to go next, before putting any money to work. I think that a break above the $1282 level is reason enough to go long, perhaps trying to reach towards the $1290 level after that, and then the $1300 level if that area gets jumped. Alternately, if we break down below the $1270 level, the market should then go down to the $1265 level.

The Federal Reserve continues to look very likely to raise interest rates, and that of course continues to weigh upon gold. If we were to break down below the $1260 level, the market should then go down to the $1250 level which is much more important on longer-term charts. It’s the “midpoint” of the overall consolidation that we have been in for some time, with the $1200 level be in the bottom and the $1300 level be in the top. I think the one thing that you can count on in this market is that it is going to be very choppy and difficult to deal with, and because of this leverage could be very difficult and potentially dangerous. Markets in general should continue to be noisy, but overall, I believe that gold is going to continue to struggle to hang on the gains as interest rates are most certainly going higher over the longer term. If the interest rates begin to fall for whatever reason in the futures market, that could help lift gold. Also, keep in mind that geopolitical tensions can also be bullish.

Gold Analysis Video 31.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement