Advertisement

Advertisement

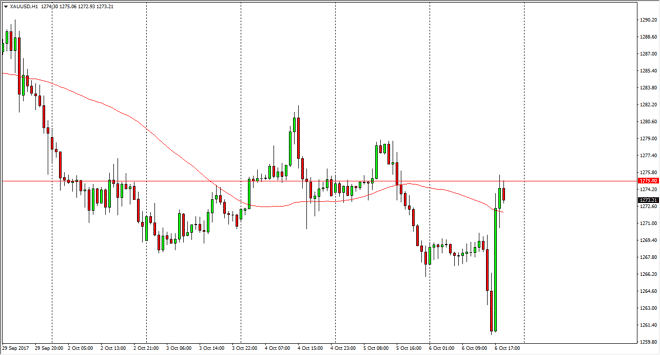

Gold Price Forecast October 9, 2017, Technical Analysis

Updated: Oct 7, 2017, 06:27 GMT+00:00

Gold markets were very volatile during the Friday session, initially selling off after the jobs number, but then turning around after it was announced

Gold markets were very volatile during the Friday session, initially selling off after the jobs number, but then turning around after it was announced that North Korea would be launching a missile that had the capacity to reach the United States over the weekend. Even with that being said, the reality is that the reaction of the market is much more short-term than it once was when it comes to all things North Korea, so I don’t expect a significant move for any major length of time. I recognize that the $1275 level above is going to be resistance, but a break above the $1280 level could send this market looking for the $1300 level again. Alternately, if we roll over from here I would anticipate that the market goes back towards the $1250 level. Gold markets are a bit thin, so they don’t necessarily move like a currency, meaning that we can have massive moves on small amounts of trade volume.

At this point, either we break above the $1080 level, or we don’t. I’m not a buyer until we do, but then again, I’m not willing to sell until we break down below the $1270 level. That volatile session of course is something that was needed, because quite frankly the markets were going nowhere. I don’t know where we go next, because there are a lot of moving pieces, but I have those levels to pay attention to so that I can get a directionality for my next trade. In the meantime, I suspect that owning gold isn’t a bad thing, but I would do so in its physical form, and take the leverage out of the position. CFD markets are preferable as well, because they allow you to tailor the size of your trade.

Gold Outlook Video 09.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement