Advertisement

Advertisement

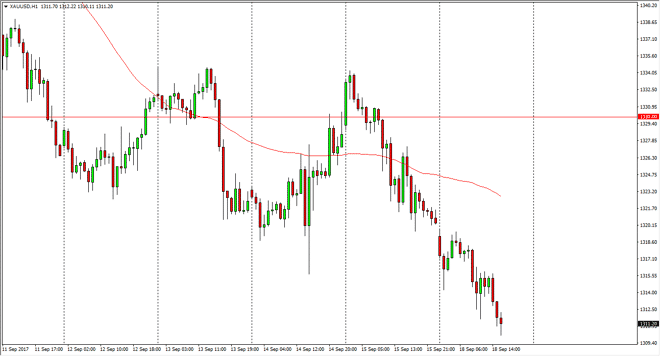

Gold Price Forecast September 19, 2017, Technical Analysis

Updated: Sep 19, 2017, 05:53 GMT+00:00

Gold markets are broken down significantly during the Monday session, capping at the open on Monday. We are now reaching towards the $1300 level, which is

Gold markets are broken down significantly during the Monday session, capping at the open on Monday. We are now reaching towards the $1300 level, which is a significant support barrier based upon previous consolidation. I think we will see a significant attempt to pick the market back up in that area, but I would have to wait for some type of supportive action to start buying. In the meantime, it’s likely that we will continue to see sellers on rallies as the markets are starting to wind down the “risk off” trade in general, which of course is bad for gold itself. However, I wouldn’t take much to change attitudes again, as the North Korean situation continues to tense up. The gap above could be filled, which is near the $1320 level. However, it’s probably to take a lot of work to get there.

A breakdown below the $1300 level would be very negative, as it would be a reentry into the consolidation area that we had been stuck in for quite some time. It is because of the previous resistance at that area, I believe that the buyers will probably return close to that level. Because of this, if you are patient enough you may get a nice buying opportunity in that general vicinity, as it should offer plenty of value. However, again, if it gets broken down then it’s a significant signal. Pay attention to the US dollar, because it tends to move counter to the gold markets overall, and if it starts to strengthen, this market will probably fall away as well. Above, I see the $1330 level as significant resistance, and it will take a significant amount of momentum building to finally break above there. My suspicion is we need some type of “event” to get the gold market moving again.

Gold Analysis Video 19.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement