Advertisement

Advertisement

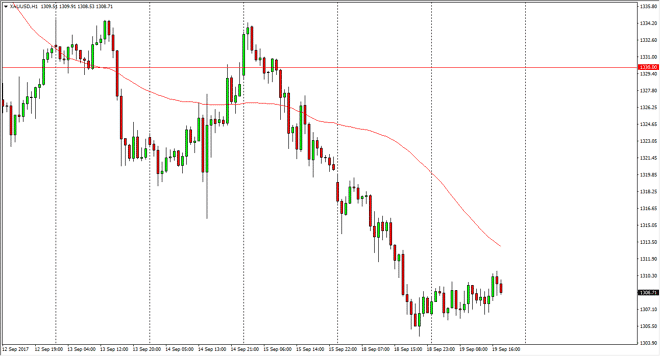

Gold Price Forecast September 20, 2017, Technical Analysis

Updated: Sep 20, 2017, 04:46 GMT+00:00

Gold markets continue to grind sideways, as we await the Federal Reserve later today. This will have a massive effect on what happens next in the Forex

Gold markets continue to grind sideways, as we await the Federal Reserve later today. This will have a massive effect on what happens next in the Forex market, thereby driving the value of the US dollar. By extension, that should have a massive effect on gold markets also, and I believe that the Federal Reserve may be a bit hesitant to raise interest rates after the hurricanes. I think that a lot of traders are feeling the same way, so that should continue to be a buying opportunity if we get the Federal Reserve sounding a bit soft. Ultimately, the market could go as high as the 1003 and $30 level, which is an area that has been resistive in the past. The $1300 level underneath is massively supportive, and I think that it’s not until we break down below there on a daily close that you can take any selloff as serious.

Buying dips

Short-term charts should offer buying opportunities based upon dips, and that’s exactly what I will use them for. Given enough time, I think that we will find plenty of reason to go long, especially as the Forex markets will certainly punish the greenback for any sign of softness coming out of the statement. If we were to break down below the $1300 level though, that would be very negative and could send this market as low as $1250 in the short term. Expect a lot of noise between now and the announcement, but I think that people are starting to look at the $1300 level as a bit of a barrier and a defining point on the chart. We have not come back to retest the $1300 level after the break out, so it makes sense that we should continue to see interest in that level.

Gold Outlook Video 20.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement