Advertisement

Advertisement

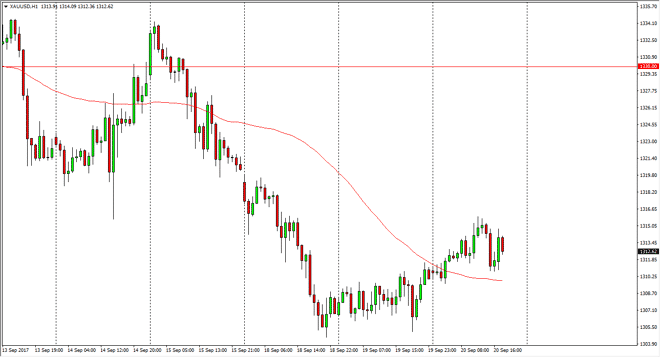

Gold Price Forecast September 21, 2017, Technical Analysis

Updated: Sep 21, 2017, 06:02 GMT+00:00

Gold markets rose slightly at the beginning of the session on Wednesday, as the markets will be paying attention to the Federal Reserve. The interest rate

Gold markets rose slightly at the beginning of the session on Wednesday, as the markets will be paying attention to the Federal Reserve. The interest rate outlook of course is interesting in the United States, in the sense that although the Federal Reserve has been suggesting that rate hikes are coming later this year, there have been a couple of destructive hurricanes sense that cycle began. Because of this, a lot of traders think that perhaps the Federal Reserve will wait on the sidelines. If that’s the case, we should see gold rise. I also recognize that the $1300 level just below is massively supportive, and that of course should continue to keep the market somewhat brilliant.

The alternate scenario

If we break down below the $1300 level, that would be a very negative sign, especially if we can continue below the $1280 level. That would be a return to the previous consolidation, and be a very bad sign for the market. In the meantime, I would expect pullbacks to be buying opportunities, as the $1300 level was the scene of a massive breakout, and in theory, should be supportive going forward. We have not retested that level significantly, so this technical moved to the downside and a bounce makes perfect sense from a technical analysis perspective. If we do get that support, I believe that the market rises towards the $1330 level above, which has been important in the past.

Keep in mind that gold markets tend to move incrementally and $10 ranges, so every $10 you should expect some type of noise. Ultimately, I do think the gold goes higher, because the “new normal” in interest rates for the Federal Reserve is probably going to be closer to 2% instead of the previous 5% we have been used to seeing out of the United States.

Gold Price Video 21.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement