Advertisement

Advertisement

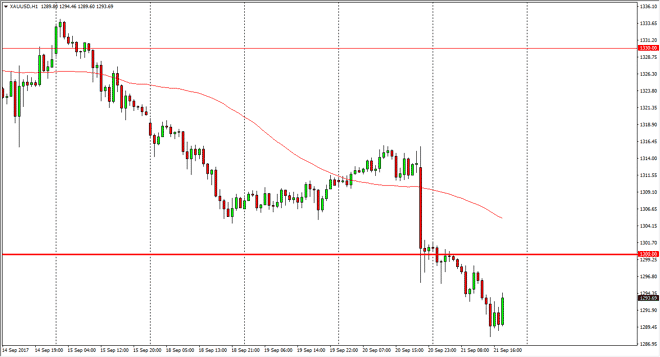

Gold Price Forecast September 22, 2017, Technical Analysis

Updated: Sep 22, 2017, 06:48 GMT+00:00

Gold markets fell significantly during the session on Thursday, breaking below the $1300 level. As I record this, it looks like we are bouncing a little

Gold markets fell significantly during the session on Thursday, breaking below the $1300 level. As I record this, it looks like we are bouncing a little bit but quite frankly I think that this was a very negative turn of events. The Federal Reserve cutting back its balance sheet should continue to put the US dollar in a positive light, and that will more than likely continue to work against the value of gold. I think the precious metal trade is coming unwound, especially considering that most of it was due to the tensions with the North Koreans. If the North Koreans and the situation in that area were to keep calm and quiet, I don’t see any reason as to why gold would suddenly rally again. In fact, I think the sellers get to be stepping on rallies as they appear.

Short-term trading

I think that short-term trading will dominate the markets, and that sellers will come in to take advantage of those short-term rallies as they appear. However, I also recognize that the markets will probably be quite volatile and therefore some traders may choose to go back and forth. For my own trading account, I will not be looking to be quite that active. The last couple of days have been very negative, and I think that probably is going to be a theme going forward. If we were to clear the $1320 level, then I would be convinced in the efficacy of the uptrend. In the meantime, I think that this market is going to continue to be very volatile and noisy, and quite frankly I would not blame any of you for staying away from it as it could probably cause quite a bit of damage to trading accounts.

Price of Gold Video 22.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement