Advertisement

Advertisement

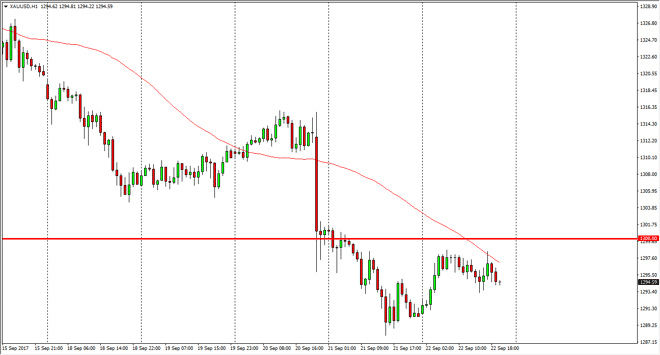

Gold Price Forecast September 25, 2017, Technical Analysis

Updated: Sep 23, 2017, 07:04 GMT+00:00

Gold markets have been interesting during the session on Friday, as we rallied enough to reach towards the $1300 level but it looks as if we don’t have

Gold markets have been interesting during the session on Friday, as we rallied enough to reach towards the $1300 level but it looks as if we don’t have the momentum to break out above there yet. If we did, that would be a bullish sign, as it would show that the support underneath has held, which I have thought of as a “pungent” between the $1300 level, and the $1290 level underneath. So far, looks like there may be enough interest in gold to start buying again, but we need to clear the $1302 level to show momentum to the upside of significance. Because of this, I am on hold right now as far as putting a position on, but I have clear parameters as to where to go next.

If we were to break down below the $1290 level, I think that the market probably goes looking for the $1275 level after that. Alternately, if we break above the $1302 level, then we go looking for the $1320 level. I think a lot of this is going to come down to risk appetite, and with the tensions rising between the Americans and the North Koreans, we may have the catalyst in Asia to make bold go higher. In fact, that could happen over the weekend, but even if it doesn’t, one would have to think we are only one or 2 headlines away from gold rallying, at least for the short term. Longer-term, the Federal Reserve looks likely to clean up its balance sheet, and that should continue to help the US dollar overall. If the US dollar gains, quite typically the gold markets will roll over although they don’t have to. That is a mistake that many rookies may, thinking that the correlation always stands true. In a safety bid, both can rally.

Gold Price Forecast Video 25.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement