Advertisement

Advertisement

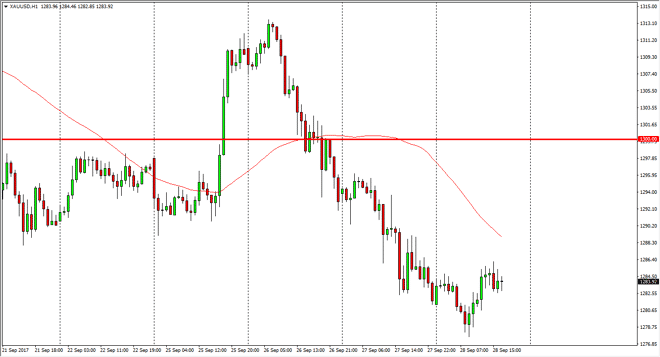

Gold Price Forecast September 29, 2017, Technical Analysis

Updated: Sep 29, 2017, 05:45 GMT+00:00

Gold markets were volatile during the Thursday session, as we initially fell towards the $1275 level, but found enough support to bounce from there and

Gold markets were volatile during the Thursday session, as we initially fell towards the $1275 level, but found enough support to bounce from there and show signs of life again. I think that the market may try to go to the $1300 level next, but keep in mind that the gold markets tend to be extraordinarily volatile and sensitive to risk appetite in general. I believe that the market should continue to be jittery to say the least, and if we get some type of noise on North Korea, it’s possible that we get an explosion to the upside. On the other side of the equation, if things stay quiet, and the US dollar continues to strengthen, it’s likely that gold will fall. The tax deal coming out of Washington DC could have an influence on this as well and I think there are a lot of moving parts to this trade.

The importance of $1275

I believe that the market breaking below the $1275 level should send this market looking towards the $1250 level after that. On the other hand, if we break above the $1300 level, the market could go much higher as it would be a very bullish sign. However, in the meantime I think it’s a lot of back and forth and of course jittery trading as we see in the precious metals market quite often. I think that we have clear lines that suggests where we will go next, but we are near them right now, so this continues to be a very noisy trade. Longer-term, the gold market should go higher based upon fundamentals, but you can almost always say that as fiat currencies tend to lose value over the longer term. In the meantime, keep your position size small.

Price of Gold Video 29.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement