Advertisement

Advertisement

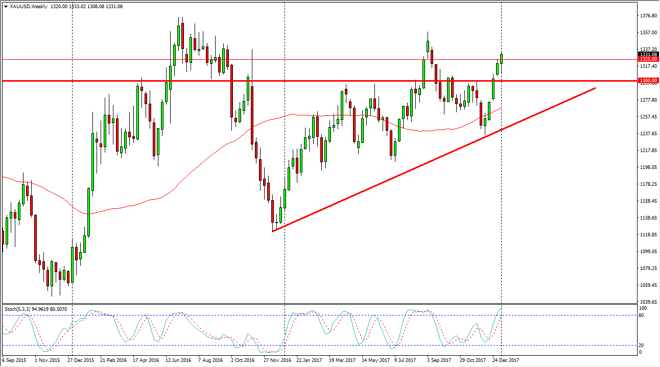

Gold Price forecast for the week of January 15, 2018, Technical Analysis

Updated: Jan 13, 2018, 03:04 GMT+00:00

Gold markets have initially fallen during the week, but turned around to form a massive hammer. We have broken above the $1325 level significantly, and that of course means that the buyers are taking over yet again.

Gold markets initially fell during the week, but turned around to form a hammer. The hammer of course is a very bullish sign, and a break above the top of the candle should send the market towards the $1350 level. The $1300 level underneath is a “floor” in the market, and I think that we should see plenty of buyers on those moves. Ultimately, if we do breakout to the upside I think that there is a lot of noise between here and $1400, but with the bullish attitude that we have seen, and more importantly the US dollar dropping significantly, it should continue to benefit the gold markets overall.

I believe longer-term “buy-and-hold” positions will continue to pay off nicely, but the volatility is going to be difficult to manage if you are over levered. It is because of this that I recognize the need for a small position is probably going to be paramount, and that means we should add slowly going forward. The marketplace continues to be one that offers a lot of opportunity, but you will have to be patient to realize the profits. If we break down below $1300, that of course changes a lot of things perhaps sending the market down to the $1275 level. However, that seems very unlikely, and I believe that the buyers have made a serious statement this past week. Adding on dips going higher is probably the best way to go, in anticipation of a challenge of the $1375 level.

Gold Technical Analysis Video 15.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement