Advertisement

Advertisement

Gold Price forecast for the week of January 2, 2018, Technical Analysis

Updated: Dec 30, 2017, 07:06 GMT+00:00

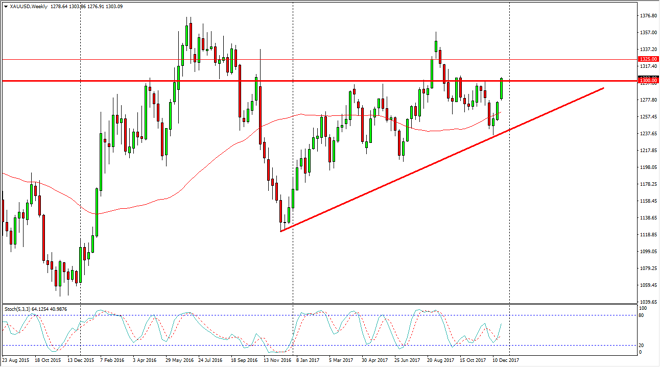

Gold markets rallied significantly during the trading of the last week, finally breaking out of the resistance barrier, and clearing the $1300 level. By doing so, it looks as if we are ready to go higher, perhaps reaching towards the $1325 level.

Gold markets rallied significantly during the week, initially gapping higher, and then breaking through a resistance barrier in the form of $1300. What’s more, we have the market closing at the very highest, and I think it’s only a matter of time before the market rallies towards the $1325 level above which has been minor support and resistance. I believe the pullbacks offer buying opportunities, and I think that the US dollar falling against other currencies around the world continues to help this market also. At this point, it’s probably only a matter of time before we get some type of geopolitical concern in the marketplace as well, and that of course helps gold too.

You can see that I have an uptrend line on the chart that should continue to offer a “floor” in the market, which is closer to the $1250 handle. I recognize that it would be a brutal selloff to reach that level, but I think it’s only a matter of time before buyers would jump in and take advantage of that value. Longer-term, I believe that this should be positive year for the gold markets, as the US dollar looks likely to continue to sell off against Betty other currencies, such as the EUR and GBP. I believe in buying dips in small amounts, and then adding as we go forward as the market continues to look very healthy. The moving averages are starting to turn higher, so that of course helps longer-term traders get involved as well.

Price of Gold Video 02.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement