Advertisement

Advertisement

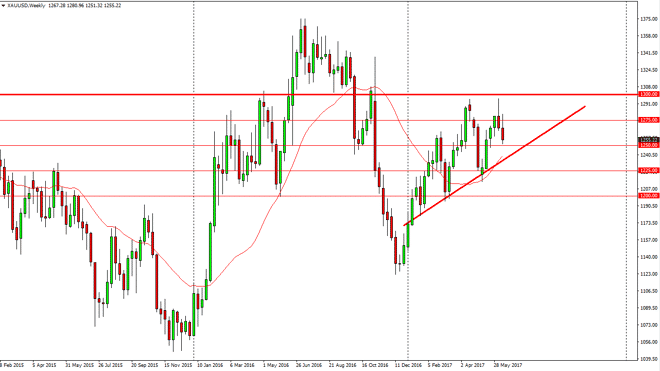

Gold Price forecast for the week of June 19, 2017, Technical Analysis

Updated: Jun 17, 2017, 07:14 GMT+00:00

Gold markets initially tried to rally during the week, but found enough trouble at the $1275 level to turn around and form a negative candle. We broke

Gold markets initially tried to rally during the week, but found enough trouble at the $1275 level to turn around and form a negative candle. We broke down to the $1250 level, which has a certain amount of psychological significance. However, the market looks as if the sellers are in control currently, but a breakdown below the $1250 level should go looking for the uptrend line underneath. We are still building up pressure to the upside, and I believe that a break above the $1300 level will signal that we are going to shoot much higher. Ultimately, the volatility continues and this being the case it’s likely that the buyers will return sooner or later. The markets have shown a significant amount of resiliency, and with the economic and global political headwinds, it’s likely that gold markets will continue to be very choppy.

Looking at value

I believe that we are looking at value when we pull back like this, and therefore it’s only a matter of time before we see value hunters coming back into this market. Again, I believe that the $1300 level above is massive resistance, and therefore a break above that market should send a fresh new group of traders into the market as gold will have proven itself yet again.

Longer-term, this is my base case scenario, that the buyers are going to if we did breakdown below the uptrend line underneath, that would be a very negative sign and could send this market looking for the $1200 level. However, I recognize that the likelihood of this is shrinking as time goes along, so I remain my bullish self when it comes to gold.

Gold Technical Analysis Video 19.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement