Advertisement

Advertisement

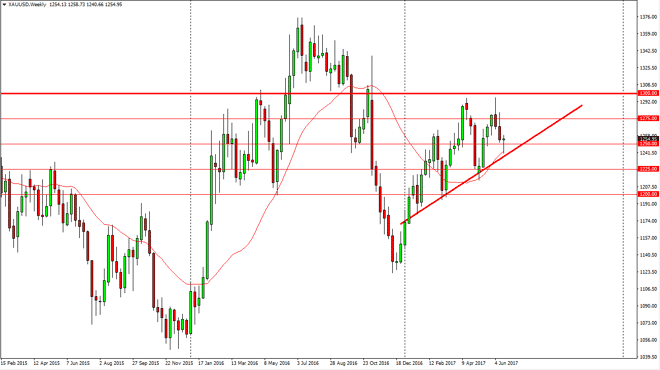

Gold Price Forecast for the Week of June 26, 2017, Technical Analysis

Updated: Jun 25, 2017, 08:55 GMT+00:00

Gold markets initially fell during the week, but found enough support at the uptrend line that has been so prevalent in the market that we turned around

Gold markets initially fell during the week, but found enough support at the uptrend line that has been so prevalent in the market that we turned around to form a significant hammer. The hammer sits just above the $1250 level, an area that will course attract quite a bit of attention. If we can break above the top of the hammer, I feel that the market should then go towards the $1275 level, followed very shortly by the $1300 level. A break above that level is a longer-term “buy-and-hold” type of situation. Pullbacks continue to offer value, as the uptrend line holds. If it does not hold, then things change, as the market should continue to see volatility. If we break down below the bottom of the uptrend line would send this market looking for the $1225 level, and then eventually the $1200 level after that.

Geopolitical concerns and the US dollar

Obviously, geopolitical concerns will continue to be a factor in this market place, and with this being the case, the market could rally on trouble a lot of places like North Korea, Syria, and even the European Union or United Kingdom. Nonetheless, I think that gold markets are still bullish so therefore I don’t really care white rallies, just that it does. A break above the top of the candle is what I will be looking for, and I will be adding along the way. If we can break above the $1300 level, I will probably wait for $1500, which would take quite some time. The market continues to find reasons to go higher, so why fight the overall attitude? It seems to be easier to go to the upside currently, so that’s exactly how I’m looking at this market.

Gold Analysis Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement