Advertisement

Advertisement

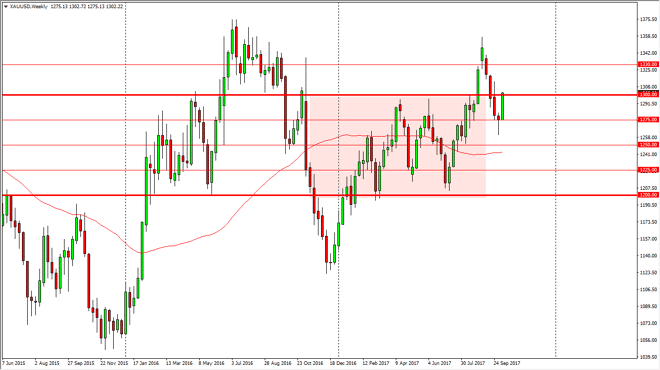

Gold Price forecast for the week of October 16, 2017, Technical Analysis

Updated: Oct 14, 2017, 05:32 GMT+00:00

The gold markets rally during the week, breaking above the $1300 level after breaking the top of a hammer from the previous week. This was a perfect

The gold markets rally during the week, breaking above the $1300 level after breaking the top of a hammer from the previous week. This was a perfect setup, and now it looks as if the gold markets are ready to go higher. On a break above the top of the weekly candle, I think we will probably be looking towards the $1325 level. I think we also break above there, but it may be a bit choppy on the way up. This massive move should continue to be a “buy the dips” scenario, especially for shorter term traders. For the longer-term trader, it’s likely that the traders will simply add physical gold or low leveraged positions. Ultimately, the market pulling back should find plenty of support at the $1275 level, and I think that we will find plenty of interest in that area. It’s not until we were to break down below the candle from the previous week, that I would be willing to start selling as it would show a breakdown.

Ultimately, the market should continue to be positive, and there are plenty of geopolitical reasons that could move gold markets higher as it tends to be a bit of a “safe haven” asset, and any type of geopolitical volatility should send this market higher. If the US dollar starts to rally significantly, the market could breakdown, but that doesn’t seem very likely to happen. It’s not likely that it happens, but we could see the US dollar strength in due to something coming out of the Federal Reserve suggesting a more aggressive monetary policy, but I don’t think that can happen anytime soon. With this, I remain very bullish gold but also recognize that reasonable position sizing will be important.

Gold Technical Analysis Video 16.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement