Advertisement

Advertisement

Gold Price forecast for the week of October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:22 GMT+00:00

Gold markets fell significantly during the week, slicing through the $1300 level and falling to the $1275 handle. Most of this would be due to the Federal

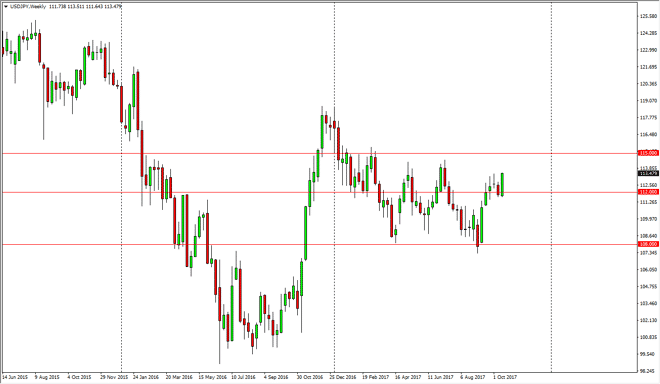

Gold markets fell significantly during the week, slicing through the $1300 level and falling to the $1275 handle. Most of this would be due to the Federal Reserve looking likely to be led by a more hawkish chairman going forward, and that of course should send this market lower as it strengthens the US dollar overall. There is a hammer from a couple of weeks previous, and if we can break below that I think it would be a very negative sign. Ultimately, the market should continue to see resistance near the $1300 level, and at that point I think selling becomes even more aggressive if we do rally. However, if we were to break above the $1305 level, the market should then go to the $1325 level.

Ultimately, this is a market that is very choppy and noisy, especially as there is a lot of speculation as to what the Federal Reserve does next. Ultimately, this is a market that could continue to be difficult to navigate for longer-term traders, until we get some type of clarity out of the Federal Reserve. Ultimately, if we do break down below here I think that the $1250 level will offer support, and then eventually we could break down below there and look towards the $1200 level. With the overall attitude of gold coming in the question, it’s going to be difficult to hang onto trades if they are of decent size, so I suspect that you will probably be better off trading small positions first, and then adding to them if the market goes in your direction. Remember, trading capital is to be protected, and that’s especially true in markets like this that should be treated with the utmost caution.

Gold Technical Analysis Video 23.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement