Advertisement

Advertisement

Important JPY Pairs’ Technical Update: 11.10.2017

By:

USD/JPY USDJPY’s sustained trading below three week old ascending trend-channel indicates brighter chances of its additional downside with 111.80 and the

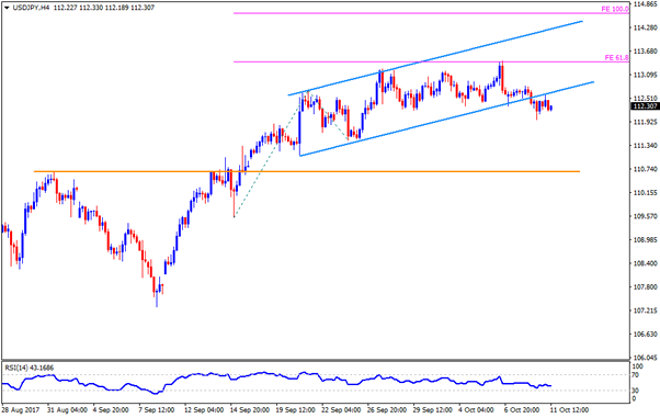

USD/JPY

USDJPY’s sustained trading below three week old ascending trend-channel indicates brighter chances of its additional downside with 111.80 and the 111.00 being likely nearby supports for the pair before it could avail the 110.65-70 horizontal-line as rest-point. Given the pair’s dip below 110.65, the 110.30 and the 109.80 may reappear on the chart. On the contrary, the support-turned-resistance line, at 112.70, and the 113.20 could act as adjacent resistances, breaking which 61.8% FE level of 113.45 and the channel-resistance of 114.25 become important to watch. In case of the quote’s upside beyond 114.25, the 100% FE level of 114.65, followed by 115.00 round-figure, may please Bulls.

GBP/JPY

With a short-term descending trend-channel confining GBPJPY’s up-moves, the pair signals the re-test of 147.40 and the 147.00 supports; however, its further downside might be curbed by 146.70-60 horizontal-area and the lower-line of channel, at 146.00 now. Should Bears refrain to respect 146.00 mark, the 145.30 and the 144.50 may flash in their radar. Meanwhile, the 148.75, comprising channel-resistance, could keep limiting the pair’s immediate upside, breaking which 149.00, the 149.45 and the 150.00 are expected levels to observe. Moreover, pair’s successful trading above 150.00 enables it to aim for 150.50 and the 151.40 resistances.

AUD/JPY

While break of four-month old ascending TL already favors the AUDJPY sellers, the pair’s inability to extend latest pullback beyond 50-day SMA provides an extra sign that it is going south. At the moment, 87.20 and the 100-day SMA level of 86.55 are expected supports that prices may avail. Though, 86.00 is the only number that can please sellers before they have to confront the 85.65-70 region. In case if the quote manages to close above the 50-day SMA level of 87.60, it needs to surpass the 88.00 round-figure in order to justify its strength in targeting the 88.70 and the 89.20 north-side numbers. Additionally, pair’s advances beyond 89.20 could well challenge the September high of 90.30.

NZD/JPY

Even if 79.20 and the 78.70 TL figure might offer immediate stops to the NZDJPY’s downturn, the pair can’t be termed strong for short-term unless clearing the 80.30-40 horizontal-line. In doing so, the quote is likely to find 80.00 and the 50-day SMA level of 80.20 as buffers. Should the pair manage to clear 80.40 on a daily closing basis, the 80.90 and the 81.65 might become buyers’ favorite. Alternatively, pair’s breach of 78.70 TL can stretch its south-run towards 78.15-10 support-line, breaking which 77.50 and the 77.00 could be expected as supports. During the pair’s decline beneath 77.00, the 76.25 and the 75.60 may become crucial for traders.

Cheers and Safe Trading,

Anil Panchal

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement