Advertisement

Advertisement

Natural Gas Forecast December 7, 2017, Technical Analysis

Updated: Dec 7, 2017, 06:02 GMT+00:00

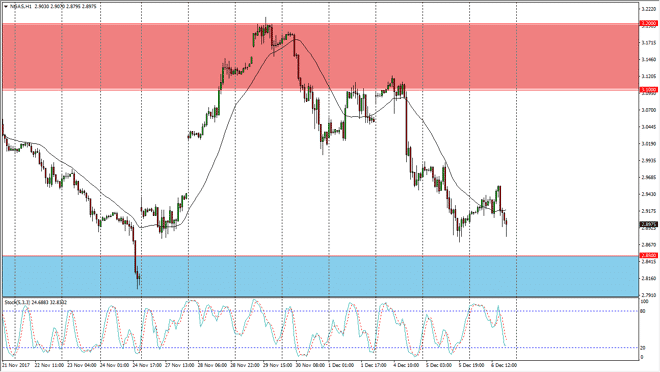

Natural gas markets continue to show a lot of volatility, initially rally during the trading session on Wednesday, but then rolled over at the $2.95 level to drop significantly again.

The natural gas markets initially rally during the trading session on Wednesday, but then rolled over to test the support again. It looks to me as if we are trying to form a little bit of a base, and perhaps rally as we continue the overall consolidation that we have seen for quite some time. We are oversold, so it makes quite a bit of sense to start buying as the $2.85 level continues to be an area of demand. The $3.10 level above should be resistive, so I think that a move to at least that area would not be much of a surprise. On the hourly chart, we are forming a bit of a double bottom, and of course a hammer on the candle that is presently forming.

In fact, I have no interest in shorting this market until we break down below the $2.75 level, which would be a complete blowout of support, and it would send this market into a very dangerous move lower. With the colder temperatures coming in the united states, it makes sense that the seasonality would bring natural buying into the market, but I think that it is somewhat limited as we have such a massive amount of oversupply in that market. Typically, we will rally towards the $3.50 level during this timeframe historically speaking, but in general it’s likely that it will be short-lived at best, as the longer-term bearish pressure still has all of the fundamental reasons to break down in general. However, in the short term it’s obvious that we have a range bound system opportunity to make money.

NATGAS Video 07.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement