Advertisement

Advertisement

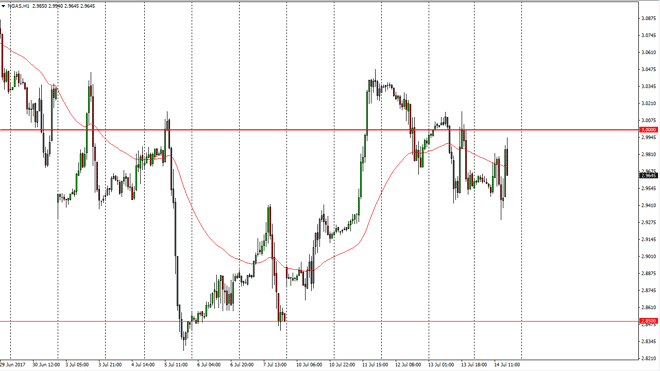

Natural Gas Forecast July 17, 2017, Technical Analysis

Updated: Jul 15, 2017, 07:12 GMT+00:00

Natural gas markets went back and forth during the session on Friday, as volatility continues. The $3 level above continues to offer massive resistance,

Natural gas markets went back and forth during the session on Friday, as volatility continues. The $3 level above continues to offer massive resistance, so it does not surprise me at all that we pulled back after trying to slam into it. However, it appears that the $2.94 level is offering support, so I think that the markets will continue to chop around but it looks as if we are trying to roll over in general. The 24-hour exponential moving average has been rolling towards the downside, and it looks like we are eventually going to see sellers come back into this market. I think that the market then goes down to the $2.85 level, and ultimately even lower than that. The milder temperatures in the United States continues to be a massive influence in this market, and this being the case it’s likely that the position signs that you should be small.

Take steps to protect herself

I believe that you should take steps to protect yourself in this market as the volatility will cause quite a bit of swings in profit, and of course losses. The market looks very likely to continue to focus on the oversupply of natural gas in the markets, and I think that should continue to be the main theme overall. I believe that rallies are to be sold, and I believe that there is a massive amount of resistance to at least the $3.10 level, which of course is quite a bit away from where we are now. A general sell on the rallies attitude continues to be what we will see going forward, and I believe that the overall bearish attitude continues with longer-term and bigger money players. Because of this, I have no interest in buying.

NATGAS Video 17.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement