Advertisement

Advertisement

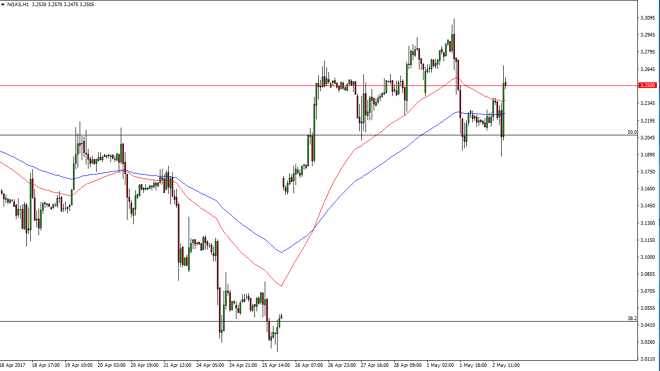

Natural Gas Forecast May 3, 2017, Technical Analysis

Updated: May 3, 2017, 03:39 GMT+00:00

Natural gas markets have had a very interesting couple of days, as we continue to bounce around in general. The 3.20 level underneath should continue to

Natural gas markets have had a very interesting couple of days, as we continue to bounce around in general. The 3.20 level underneath should continue to offer support, just as the $3.25 level above has offered a bit of resistance over the last few hours. Ultimately, I believe that the market probably reaches towards the $3.30 and then the $3.33 level above. The gap below should indicate that there’s a lot of buying pressure in this market, and it appears that the 24-hour moving average is starting to turn to the upside. Because of this, I still believe that pullbacks will be short-term buying opportunities but keep in mind that the futures market in natural gas is very expensive at times.

The impulsive hourly candle that broke above the $3.25 level should be a sign of strength, and although we could turn around to fill that massive gap, right now it doesn’t look likely unless we break down below the $3.17 level, which would show a bit of weakness. At that point, you could play short-term selling positions to fill the gap, but keep in mind that there is still a massive amount of bullish pressure underneath that you will have to deal with if that’s the case. The market looks very volatile but with a bullish bias, so you have to keep in mind that selling will be a bit dangerous, so using tight stop losses will probably have to be how you play in the short positioning. As far as going long is concerned, I would be much more patient as I believe the rewards will be much greater on the long side of the market. Either way, expect choppiness as the natural gas markets tend to be such anyway.

NATGAS Video 03.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement