Advertisement

Advertisement

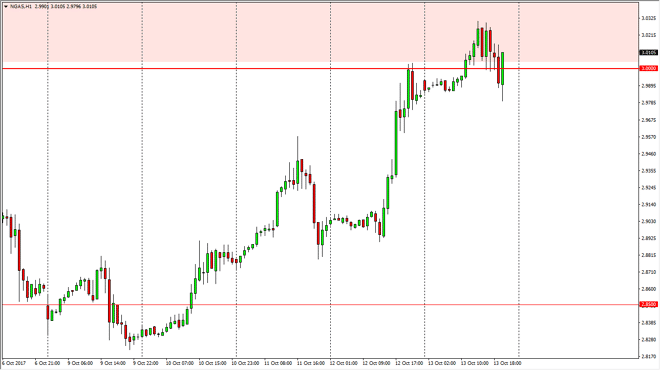

Natural Gas Forecast October 16, 2017, Technical Analysis

Updated: Oct 14, 2017, 05:29 GMT+00:00

The natural gas markets went sideways initially on Friday, but then rallied above the $3.00 level to go looking towards the $3.03 level. That area offered

The natural gas markets went sideways initially on Friday, but then rallied above the $3.00 level to go looking towards the $3.03 level. That area offered enough resistance to turn things around and roll over to break down below the $3.00 level. Ultimately, if we can break down below the bottom of the range for the day, we have essentially triggered a breakdown below a shooting star on the daily chart, and therefore think the market goes down to the $2.90 level. After that, the $2.85 level makes a lot of sense as well. Keep in mind that the natural gas markets have continue to find massive amounts of resistance above, and I think that will continue to be a place as US fracking companies be, profitable above that level. Ultimately, I think that the markets are ones that continue to show trouble going forward, so therefore I have no interest in buying as the oversupply of natural gas above will continue to put a bit of a lid on price action.

A breakdown below the bottom of the range for the day, I would not only be selling, but I think I could become very negative and aggressive when it comes to shorting. The $2.85 level underneath will be supportive, but we could break down below there. Nonetheless, the market should continue to see plenty of problems going forward, as American suppliers will be more than willing to dump their oversupply into the market so that they can continue to make money. Ultimately, this market is unable to be bought, mainly because the oversupply is so large. Once we get to this area just above, it seems as if the sellers become massively aggressive in this market, and I think that will continue to be the norm for the next several months.

NATGAS Video 16.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement