Advertisement

Advertisement

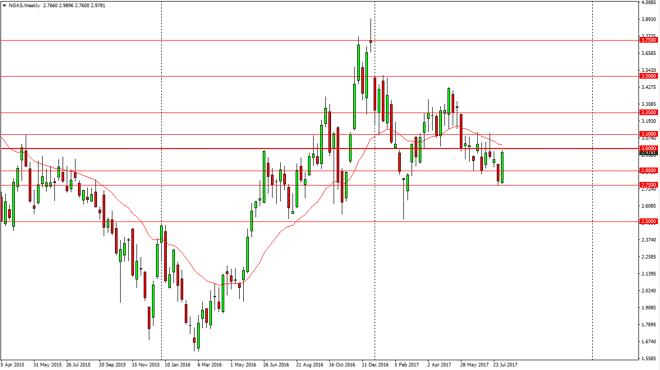

Natural Gas forecast for the week of August 14, 2017, Technical Analysis

Published: Aug 12, 2017, 04:31 GMT+00:00

Natural gas markets exploded to the upside during the week, testing the $3.00 level. This is a market that sees a significant amount of resistance at the

Natural gas markets exploded to the upside during the week, testing the $3.00 level. This is a market that sees a significant amount of resistance at the $3.00 level, extending to the $3.10 level above. I believe that there is a massive amount of resistance, so I think it’s probably going to end of being a selling opportunity. Longer-term traders may have to grind down to shorter-term charts, sending this market down to the $2.75 level, if not the $2.50 level after that. That’s not to say that it will be easy, but these impulsive candle’s, and go in this market as it is relatively illiquid. If we broke above the $3.10 level, then the market could go to the $3.25 level above, which is even more resistive.

Short-term charts

I believe that short-term charts are probably going to be the best way to go going forward, as there will be as much room on the longer-term charts to continue the downward trend. The oversupply of natural gas will continue to be an issue statistically and systematically. Because of this, I am a seller and not a buyer, despite what we have seen over the last week. Ultimately, it’s only a matter of time before the resistance comes back into play. By shorting with a small position, this gives you the ability to deal with the volatility, and then the ability to add to your position as it moves in your direction. If the trade does go against you, a smaller position sizes will make the losses tolerable, and give you the ability to reenter the market at a higher level. Currently, I do not have a scenario in which I’m comfortable buying this market on the longer-term.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement