Advertisement

Advertisement

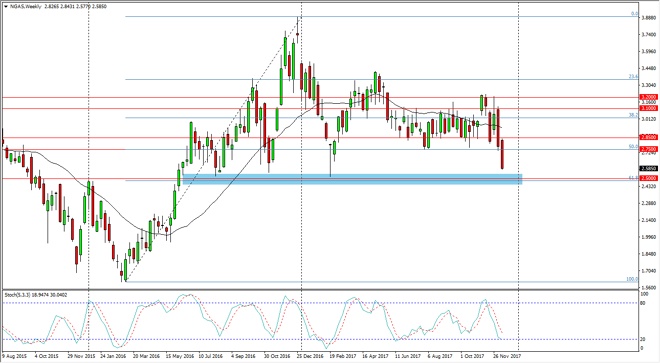

Natural Gas forecast for the week of December 18, 2017, Technical Analysis

Updated: Dec 16, 2017, 05:04 GMT+00:00

Natural gas markets collapsed during the week, breaking below the vital $2.75 level. In fact, as we close the market for the week, we were below $2.60 as well.

Natural gas markets broke down below the $2.75 level, and close towards the bottom of the range. That is a very negative sign, but as you can see the $2.50 level underneath is marked on my chart as a very important area. This is the 61.8% Fibonacci retracement level of the bigger move from almost 2 years ago, and an area that continues to find plenty of buyers. If we do bounce from here, we could rally quite significantly, perhaps as high as $3.10. Because of this, I think that the weekly candle at the end of this week will be very important. In fact, longer-term trades should probably wait until we get this weekly candle.

If we get a weekly close below the $2.50 level, it’s likely that the market will completely fall apart at that point. I would be surprised by that, but I’m the first to admit that this last couple of weeks has been brutal. If we get a bounce or a hammer, something along those lines, then I think it’s very likely that we return to the mean, which is much higher. This is my base case, so that’s the more comfortable trade. The stochastic oscillator looks as if it is getting close to the oversold range, and a cross could be coming rather soon. Because of this, I would love to see a hammer that I can take advantage of. Color tempers in the northeastern part of the United States could keep this market afloat, but quite frankly I could have said that 2 weeks ago.

NATGAS Video 18.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement