Advertisement

Advertisement

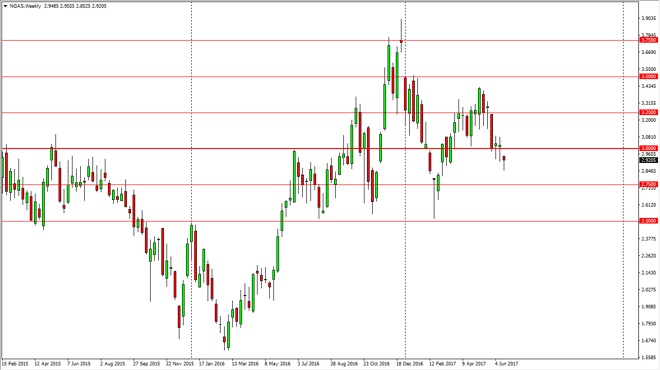

Natural Gas forecast for the week of June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:15 GMT+00:00

Natural gas market gapped lower at the open on Monday, and then broke down significantly. However, as we went deeper into the week, we turned around to

Natural gas market gapped lower at the open on Monday, and then broke down significantly. However, as we went deeper into the week, we turned around to form a hammer. This hammer suggests that there is going to be some buying, but the $3.00 level above should be resistance. I don’t have any interest in buying though, because of all of the resistance and the lack of a risk to reward ratio. I’m looking to see some type of exhaustive candle near the $3.00 level that I can turn around and search shorting. Alternately, if we break down below the bottom of the hammer, then the market goes down to the $2.75 level. Given enough time, the market should break down below there even, perhaps reaching down to the $2.50 level.

Lack of demand

There’s a serious lack of demand when it comes to the natural gas markets, as the oversupply continues to be such a massive problem. I believe that every time we rally, there will be sellers coming back into this market in order to punish natural gas. I think that if we can break down below the $2.50 level, the market is going to absolutely collapsed. If we do break above the $3.10 level, the market will then go to the $3.25 level above there. Ultimately, this is a market that should continue to be choppy, and with this being the case I think that you should get plenty of opportunities to short this market not only on the longer-term charts, but short-term charts that show signs of exhaustion. I have no interest in trying to find the overall selling off of this commodity, and therefore am a “sell only” trader until of course we break out to the upside.

NATGAS Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement