Advertisement

Advertisement

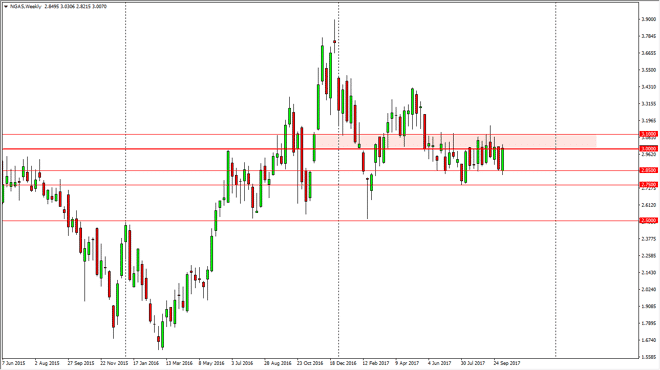

Natural Gas forecast for the week of October 16, 2017, Technical Analysis

Updated: Oct 14, 2017, 05:32 GMT+00:00

Natural gas markets initially dropped during the week, dipping below the $2.85 level. However, we rallied from there to reach towards the $3.00 level

Natural gas markets initially dropped during the week, dipping below the $2.85 level. However, we rallied from there to reach towards the $3.00 level above, which continues to offer significant amounts of resistance. Ultimately, this is a market that continues to see sellers jump in there, mainly because US fracking companies continue to find enough profitability to dump their massive amounts of supply into the marketplace. Because of this, I think we will continue to see a massive ceiling in this general vicinity, perhaps to the $3.11 level. I think that short-term traders will be looking for exhaustive candles to start selling. I think that given enough time, the market will reach towards the $2.85 level again. I think we can also break down below there, reaching towards the $2.75 level. This is a market that continues to see plenty of negativity as we are so oversupplied that the market cannot hold value.

If we were to break down below the $2.75 level, the market should then go down to the $2.50 level. Alternately, if we were to break above the shooting star candle from 4 weeks ago, that should be reason enough to go long. I don’t think that happens though, because there so much in the way of supply that it’s almost impossible to imagine it happening. I think that longer-term, we probably try to go to the $2.50 level but I don’t think it’s good happen anytime soon. After all we are starting to get cold weather in the United States, but the oversupply is going to continue to keep this market from rallying too much. That is a perfect scenario for continued choppiness, so I prefer to trade off of short-term charts, as it gives you more room to move.

NATGAS Video 16.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement