Advertisement

Advertisement

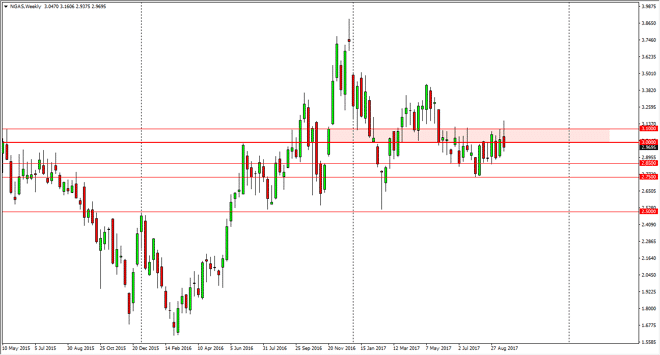

Natural Gas forecast for the week of September 25, 2017, Technical Analysis

Updated: Sep 23, 2017, 07:09 GMT+00:00

Natural gas markets have been all over the place during the last week, and had at one point even broke above the $3.10 level, an area that has been

Natural gas markets have been all over the place during the last week, and had at one point even broke above the $3.10 level, an area that has been massive resistance as of late. Later in the week, we got an inventory number that was much larger than anticipated, even in the wake of 2 major hurricanes in the United States. This through the market into disarray again, and we turned around to fall below the $3 level again. By doing so, we have form a massive shooting star, and I think we are going to continue to see sellers in this market, as we reach towards the $2.85 level underneath. Below there, the neck support level is to be found at the $2.75 level. I think the volatility will continue to be a mainstay in this market, and quite frankly it’s probably better suited for short-term trading than anything else. However, I would be the first to point out that it looks like a little bit of a head and shoulders has been forming, and if we break down significantly, we could really start to see the sellers take over. We are heading into a typically stronger time of the year, but the oversupply continues and I think it will continue to be the main story.

At this point, I’m not sure what will send natural gas prices higher for the longer term. Because of this, I’m looking for selling opportunities, but as I mentioned previously, it’s going to be easier to deal with this market on shorter time frames than the weekly chart. However, if I was forced to take a trade on this time frame, it would most certainly be a selling position and not a buying position.

NATGAS Video 25.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement