Advertisement

Advertisement

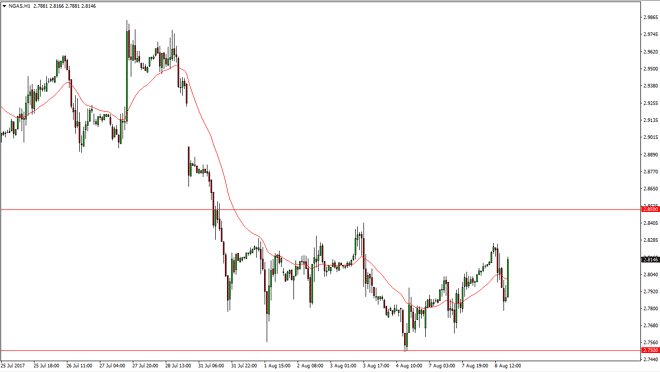

Natural Gas Price Forecast August 9, 2017, Technical Analysis

Updated: Aug 9, 2017, 05:05 GMT+00:00

Natural gas markets initially tried to rally during the day on Tuesday, but then fell significantly as the Americans stepped on board. However, we turned

Natural gas markets initially tried to rally during the day on Tuesday, but then fell significantly as the Americans stepped on board. However, we turned around a little bit later, to show signs of strength again. I think we are currently consolidating more than anything else and I think that a break higher could be possible, but it will be short-lived. The $2.85 level above should continue to show signs of resistance, and even if we break above there, we have a significant gap from several sessions ago that should continue to be a bit of a lid in this market. I think that an exhaustive candle is exactly what we are looking for to start shorting, but we don’t quite have it yet. The higher we go, the more likely I am to sell this market.

Breaking 2.75

The I believe that eventually we will break down below the $2.75 level, and then go looking to the $2.50 level longer term. I think that there is a lot of work to be done to chip away at that support level, servers and we rally I think that sellers will continue to jump into this market as we build up momentum. I have no interest in buying this market, it simply a matter of waiting for the sellers to return so that I can get involved. Ultimately, we are still oversupplied with natural gas, and that should continue to be the case in the foreseeable future. Once we break down below the $2.75 level, I would have a core short position, and supplemented from time to time on short-term rallies in order to maximize profits as we will almost undoubtedly have significant amounts of volatility underneath the $2.75 level and below as it would be a significant break down.

NATGAS Video 09.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement