Advertisement

Advertisement

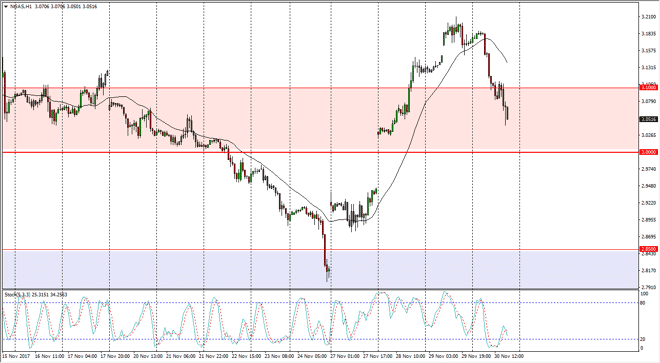

Natural Gas Price Forecast December 1, 2017, Technical Analysis

Updated: Dec 1, 2017, 04:10 GMT+00:00

Natural gas markets continue to be very volatile, and quite frankly a dangerous place the trade. We have broken down during the Thursday session, but signs of life are appearing again.

Natural gas markets fell significantly during the trading session on Thursday, reaching down towards the $3.03 level. There should be a certain amount of support at the $3 handle though, as it is a psychological barrier and of course the top of the gap from a few sessions ago. As a record this, it looks like we are trying to form some type of base at this point, and a break above the $3.10 level should send the market to the upside, perhaps looking towards the $3.20 level. That area has been resistance, and of course should attract some bearish pressure. Nonetheless, I think at this point the market isn’t trading so much from a technical analysis standpoint, but rather based upon the weather forecast of the next week in the northeastern part of the United States. Because of this, it’s very difficult to trade this market with any significant type of leverage, as the market continues to see a lot of violent moves.

A breakdown below the $3 level should send this market towards the $2.94 level, to fill the gap. On the other hand, if we were to break above the $3.20 level, I think the next target would be the $3.25 handle, which has been resistive in the past. A break above there then frees the market to go much higher, showing signs of the typical seasonality of December when it comes to the natural gas markets. However, by the time we get to the middle of January, it’s quite frankly typical that the natural gas markets breakdown. In other words, this may be a short-term buying opportunity, but longer-term I remain bearish.

NATGAS Video 01.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement