Advertisement

Advertisement

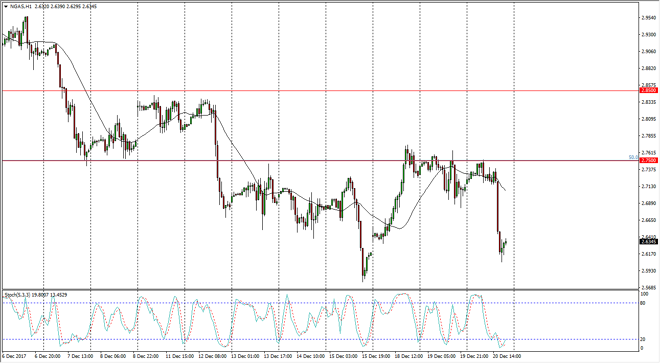

Natural Gas Price Forecast December 21, 2017, Technical Analysis

Updated: Dec 21, 2017, 05:58 GMT+00:00

Natural gas markets fell rather precipitously during the trading session on Wednesday, reaching down towards the $2.60 level. We are starting to bounce a little bit, and I think there is significant support just below, so perhaps we will continue to see choppiness.

The natural gas markets went sideways initially during the trading session on Wednesday, but then broke down to the $2.60 level. There is plenty of support just below the $2.50 level though, so a bounce from here makes quite a bit of sense, but I also think that the $2.75 level should offer a significant amount of resistance. In the next couple of sessions, liquidity will become an issue, especially as most natural gas trading is done in the United States, and we are heading towards Christmas. The lack of volume will probably cause more of a range bound type of situation, so smaller traders might be able to take advantage of this in the CFD market, trading back and forth using some type of range bound situation. The stochastic oscillator is in the oversold range and crossing, but I think that this is a short-term rally, and will face a significant amount of resistance near the $2.75 level, and signs of weakness there could be a selling opportunity. This is a market that I think we should continue to think of in a negative light, but we are getting close enough to major support that I am willing to concede the short-term rally.

If we break above the $2.75 level, then we will test the $2.85 level after that. I would expect to see even more resistance there, so I think the volatility will continue, at least for these next several situations. The time of years typically bullish for natural gas, but we clearly are not seeing that this time.

NATGAS Video 21.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement