Advertisement

Advertisement

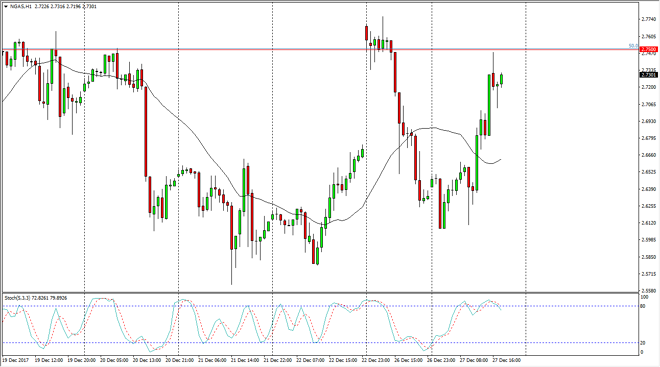

Natural Gas Price Forecast December 28, 2017, Technical Analysis

Updated: Dec 28, 2017, 05:03 GMT+00:00

The natural gas markets initially skyrocketed during the trading session on Wednesday, but in thin volume it found the $2.75 resistance level to be a bit too resistive to continue going higher. Ultimately, I think the one thing you can count on is volatility.

Natural gas markets initially fell during the trading session on Wednesday, but found enough support near the $2.60 level to turn things around and rally significantly. We reached towards the $2.75 level above, which has been an area that has shown a significant amount of resistance. That area should continue to be very important, and the fact that we are starting to struggle in this area suggests to me that if we drop a few cents, we could break down significantly, perhaps reaching towards the $2.60 level yet again. Ultimately, this is a market that I think continues to be very volatile this time of year, as volume is thin.

I believe that there are going to be serious issues keeping the natural gas markets from rallying anytime soon, considering that the time of years typically bullish for natural gas, but every time we rally the sellers return. If the seasonality cannot help the pricing of natural gas, it’s likely that the rallies will offer shorting opportunities, as perhaps the market will go looking to the $2.50 level longer term. Otherwise, if we break above the $2.75 level, the market probably goes towards the $2.85 level above there, as it has also been massively resistive. This time of year, it’s difficult to hang onto a position and of course trade a large one, as there is a serious lack of liquidity, and of course the larger scale traders are on the sidelines and not being involved in the futures market.

NATGAS Video 28.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement