Advertisement

Advertisement

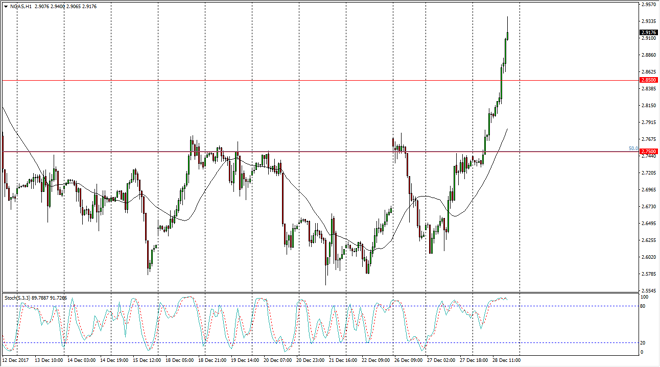

Natural Gas Price Forecast December 29, 2017, Technical Analysis

Updated: Dec 29, 2017, 04:54 GMT+00:00

Natural gas markets rallied significantly during the trading session on Thursday, as the storage numbers met expectations. In a twist of irony, by simply doing what they were supposed to, this scent prices going much higher. Lately, we have seen massive disappointment in those announcements, so having said that I think that this is a bit of an overreaction.

Natural gas markets exploded to the upside on Thursday, breaking above the $2.85 level handily. As a record this, we are close to the $2.92 level, and showing signs of running out of steam. We are overbought on the hourly chart stochastic oscillator, and crossing. Because of this, I am getting ready to start shorting this market, but I would probably wait until we dropped below the $2.90 level at the very least. After all, it’s a very thin marketplace, so it’s likely that the move might have been overextended and a bit overdone. I think in the thin marketplace, you can only read so much into this move, and quite frankly I think the fact that the market has reacted this way gives us a bit of an opportunity as they are going to be as likely to be mispriced as any other time. I think that the market moving down towards the $2.75 level is a very real possibility. If we do continue to go higher, I’m waiting for the market to go looking towards the $3.10 level to start selling again. I have no interest in buying natural gas, every time I do I end up getting burned.

I believe that the selling of natural gas during what would normally be bullish time of year tells me everything I need to know, and at this point I’m just waiting for the market to tell me to short the market again.

NATGAS Video 29.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement