Advertisement

Advertisement

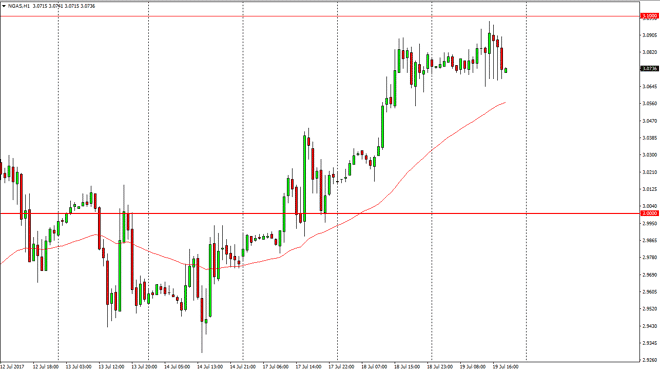

Natural Gas Price Forecast July 20, 2017, Technical Analysis

Updated: Jul 20, 2017, 06:22 GMT+00:00

As I write this, the natural gas markets have tried to break above the $3.10 level, but we have turned around to form what could be a shooting star in the

As I write this, the natural gas markets have tried to break above the $3.10 level, but we have turned around to form what could be a shooting star in the market. I believe that natural gas markets are overbought, and I also believe more importantly: oversupplied. As natural gas inventory announcements come out during the day today, it’s likely that we will see quite a bit of volatility and of course movement in the market due to that. I think that the $3.12 level above continues to be massively resistive, so I am a seller of exhaustive candles on short-term charts. Given enough time, the market should then go down to the $3.00 level, which will have a certain amount of psychological importance. However, and the end the market will continue to sell a market that has no real pricing power.

Selling rallies

I continue to sell rallies that show signs of exhaustion, or even a “lower low.” The market should continue to go down to the $3.00 level, and a breakdown below there should send the market to the $2.95 level. I have no interest in buying, and even if we break above the $3.12 level above, I think that it’s only a matter of time before sellers return. It might be a short-term buying opportunity for those of you who are nimble enough, but quite frankly I would just look for higher levels to sell from, as it would just give the market much more room to fall.

NATGAS Video 20.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement