Advertisement

Advertisement

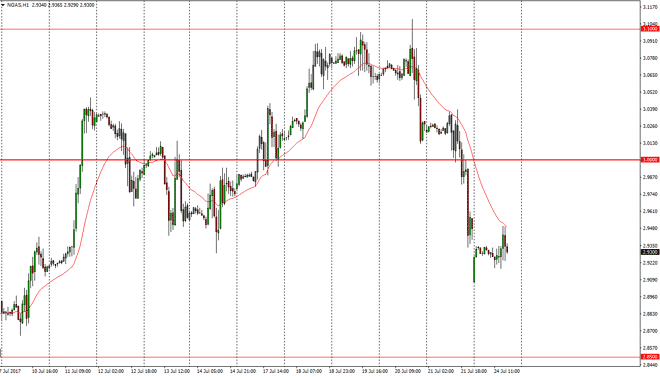

Natural Gas Price Forecast July 25, 2017, Technical Analysis

Updated: Jul 25, 2017, 04:14 GMT+00:00

Natural gas markets gapped lower at the open on Monday, and then rallied enough to fill that gap. We are approaching the 24-hour exponential moving

Natural gas markets gapped lower at the open on Monday, and then rallied enough to fill that gap. We are approaching the 24-hour exponential moving average as I record this video, which could cause a bit of resistance. I also believe that the $3.00 level above should continue to offer quite a bit of resistance as well, and I certainly believe that the oversupply of natural gas continues to overhang the market, and therefore I most certainly prefer shorting this market than anything else. I think given enough time we will go looking towards the $2.85 level, and I look at exhaustion as opportunities to get involved. Even if we break above the $3.00 level, I think there is far too much in the way of resistance to think that the market is going to go higher for any real length time.

Selling rallies

I believe in selling short-term rallies that show signs of exhaustion, and of course fresh, new lows. I think that the $2.85 level will be the target initially, but I would not be surprised at all to see this market break below there, and continue going towards the $2.75 level after that. I have no interest in buying the market, and I believe that the $3.10 region continues to offer the absolute “ceiling” in the market, as we continue to see oversupply in work against the value of natural gas longer-term, and there seems to be more than enough supply at the $3.10 level to abate any bullish pressure that we continue to see in the market. While we are getting close to the bottom of the most recent consolidation area, longer-term I think that the bottom breaks down so therefore I am patient enough to simply wait for selling opportunities.

NATGAS Video 25.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement