Advertisement

Advertisement

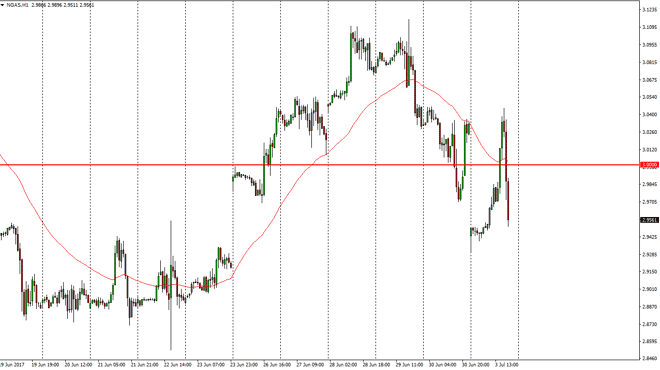

Natural Gas Price Forecast July 4, 2017, Technical Analysis

Updated: Jul 4, 2017, 04:44 GMT+00:00

Natural gas markets gapped lower at the open on Monday, all the way down to the $2.93 level. However, we turned around to fill that gap, and now have seen

Natural gas markets gapped lower at the open on Monday, all the way down to the $2.93 level. However, we turned around to fill that gap, and now have seen a massive amount of resistance and bearish pressure. If we can break down below the $2.93 level again, I think that this market will continue to crater as natural gas is so oversupplied. I believe that the warmer temperatures in the United States, although offering a short-term buying opportunity, won’t be enough to change the overall outlook of this market, as there is so much in the way of oversupply and ultimately, not anywhere near enough demand. The markets will be volatile as per usual, but certainly should continue to face a significant amount of selling pressure.

Selling rallies

I continue to sell rallies, because quite frankly the longer-term direction almost certainly will continue to favor the negative pressure. I think that we will go looking for the $2.85 level, and then possibly the $2.75 level underneath. Breaking below there should send this market down to the $2.50 level, which I think is even more support there as it is the bottom of the recent move lower, and that being the case it looks as if it should be massively supportive. If we did breakdown below there, I think that the market will come unraveled. In fact, it would be breaking the bottom of a massive and shoulders that should send this market even lower, and a currently looks as if there’s nothing to stop that happening in the longer term. Rallies continue to be selling opportunities that I plan on taking advantage of, as this market gets so negative so quickly. Buying isn’t even a thought at this point in time.

NATGAS Video 04.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement