Advertisement

Advertisement

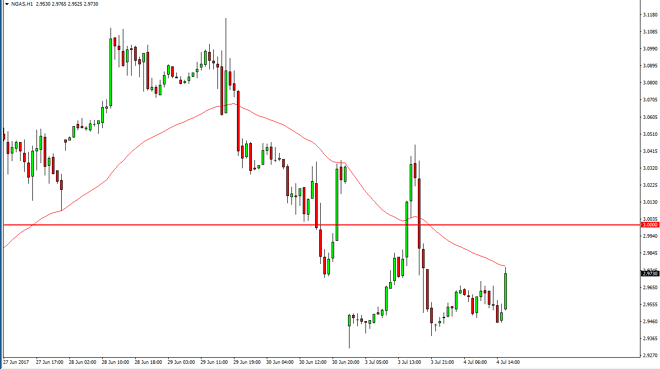

Natural Gas Price Forecast July 5, 2017, Technical Analysis

Updated: Jul 5, 2017, 04:52 GMT+00:00

The natural gas markets were volatile during the session on Tuesday, but this would be expected as Americans were away celebrating Independence Day.

The natural gas markets were volatile during the session on Tuesday, but this would be expected as Americans were away celebrating Independence Day. Because of this, the markets would have been very thin, and that of course works against the value of moves. I think that not too much could be read into what happened, but it I still believe that the longer-term attitude on this market will continue to go lower. I think that rallies are selling opportunities, especially near the $3 level which should be psychologically resistive. You can see that the short-term rally that we have seen during the thin day was thwarted by the 24-hour exponential moving average, and that the $2.93 level underneath continues to offer support. If we can break down below there, the market should continue to go even lower, perhaps reaching down to the $2.90 level, and then eventually the $2.85 level.

Selling rallies

I continue to sell rallies in a market that for me is a “sell the rallies” situation. Because of this, I look at large candles like we see on the one hour chart as selling opportunities, and will certainly take advantage of the first signs of exhaustion. However, during the session we could see a bit of volatility as traders come back to work, reestablishing positions that certainly have been profitable over the last couple of days. It will be volatile, but in the end, there is a massive oversupply natural gas, and that will continue to put pressure on a market that simply cannot get out of its own way longer term. Eventually, I think that the market continues to go down to the $2.50 level longer term. Buying is all but impossible as far as I can see.

NATGAS Video 05.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement