Advertisement

Advertisement

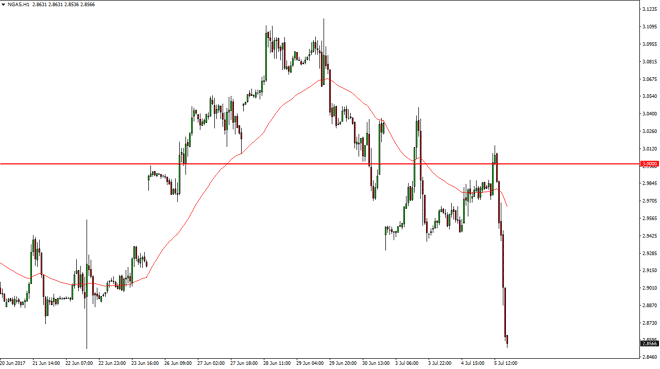

Natural Gas Price Forecast July 6, 2017, Technical Analysis

Updated: Jul 6, 2017, 05:01 GMT+00:00

The natural gas markets initially tried to rally during the day but then collapsed once we try to break above the $3.00 level. In fact, this is one of the

The natural gas markets initially tried to rally during the day but then collapsed once we try to break above the $3.00 level. In fact, this is one of the most bearish movies I’ve seen in this market as of late, and I believe that the bearish pressure is going to continue to punish natural gas as the oversupply is simply far too strong. Major power producers as switching to coal in the United States again, and that of course brings down the demand for natural gas even further. The natural gas markets continue to be very volatile overall, and I think that at this point in time any time this market rallies, it’s and I selling opportunity on signs of exhaustion. If we can break down below the $2.85 level, and I think we will, the market then goes looking towards the $2.75 level underneath.

Rallies are to be sold

I have no interest whatsoever in buying natural gas, and every time we rally I think looking for exhaustion is the best way to go. Selling down here of course is “chasing the trade”, but waiting for rally gives us a little bit more momentum building capabilities to send the market much lower. I have no interest in buying, as the $3 level now looks to be the “ceiling” in the market, and I would be absolutely shocked if we broke above there anytime soon. If we did, that would be a major change of momentum, but I don’t really see a scenario where we get there. The $2.50 level underneath is my longer-term target, and I believe that we will reach that level over the longer term as we will continue to see natural gas markets react to the horribly weak fundamentals.

NATGAS Video 06.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement