Advertisement

Advertisement

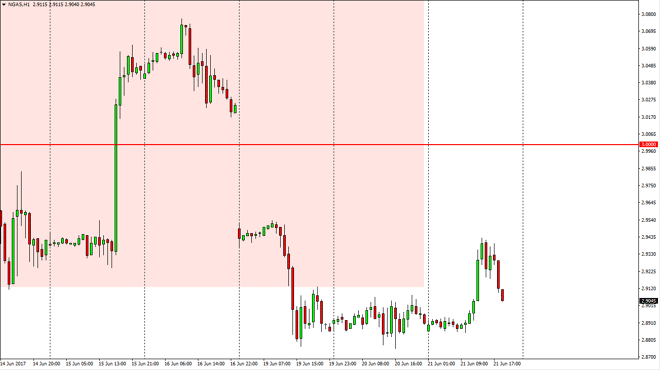

Natural Gas Price Forecast June 22, 2017, Technical Analysis

Updated: Jun 22, 2017, 04:43 GMT+00:00

The natural gas markets went sideways during the session initially on Wednesday, and then shot up to the $2.94 level. We found enough resistance there to

The natural gas markets went sideways during the session initially on Wednesday, and then shot up to the $2.94 level. We found enough resistance there to turn things back around to fall significantly, and therefore looks likely to see various pressure. I think that a breakdown below the $2.88 level and should send this market down to the $2.80 level, and then the $2.75 level. There is a gap above that continues to put bearish pressure in this market, extending all the way to the $3.02 level. I think that the downward pressure could continue to weigh upon the market, and I think that the longer-term downward pressure is not only due to US dollar strength, but the massive amount of oversupply that we see in the market currently. With this in mind, I have no interest in buying this market and I believe that every time we rally, it’s a selling opportunity.

Selling

Selling is the only thing that I am going to do, as far as putting money to work. However, I believe that sometimes we will have to be on the sidelines as we may get bits of volatility that make the market difficult to navigate. The market continues to be very difficult to deal with to the upside, and only the truly fully sure trying to fight this trend. As I write this, I’m watching the market fall apart, and I believe that the sellers are becoming more aggressive yet again. It is not until we break above the 3.03 level that I would consider buying this market, and that doesn’t seem to be happening anytime soon. Because of this, we ultimately see various pressure only at the moment, and I don’t think that it’s going to change anytime soon.

NATGAS Video 22.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement