Advertisement

Advertisement

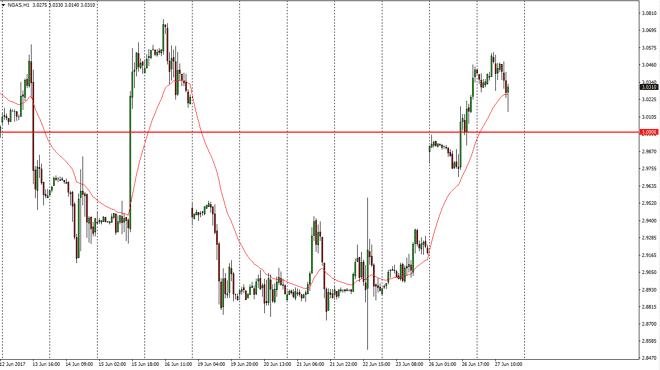

Natural Gas Price Forecast June 28, 2017, Technical Analysis

Updated: Jun 28, 2017, 05:47 GMT+00:00

Natural gas markets went sideways during the day on Tuesday, as we continue to see quite a bit of interest in this market. The $3 level is looking like it

Natural gas markets went sideways during the day on Tuesday, as we continue to see quite a bit of interest in this market. The $3 level is looking like it is trying to offer support, and of course the 24-hour exponential moving average on the chart is showing signs of support as well. If we can break down below the $3.00 level, then I think we go down to fill the gap. Longer-term, we are most certainly in a negative downtrend, so I think that it is only a matter of time before we break down. If we did manage to break above the 3.08 level on a daily close, then I would be a buyer, at least short-term. There is a significant amount of resistance above. Ultimately, I think that the market reaches down to the $2.88 level, to test significant support underneath.

Volatility continues

I believe that volatility continues in this market, and with this being the case it’s likely that the will chop around, but I still favor the downside as the market is massively oversupplied, and ultimately, I think that overcomes everything in general. I also believe that we break down significantly given enough time, but we continue to chop around overall. If we do breakdown, I think we will massively pick up momentum in a downtrend that is strong and continues to be supported by the storage numbers coming out of both the United States and Canada.

If we do breakdown, the $2.92 level underneath should be a target as we close the gap underneath, as the market hates gaps longer term. I believe that given enough time the market continues to do what it always does, bounce around and close gaps. Natural gas continues to cause issues.

NATGAS Video 28.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement