Advertisement

Advertisement

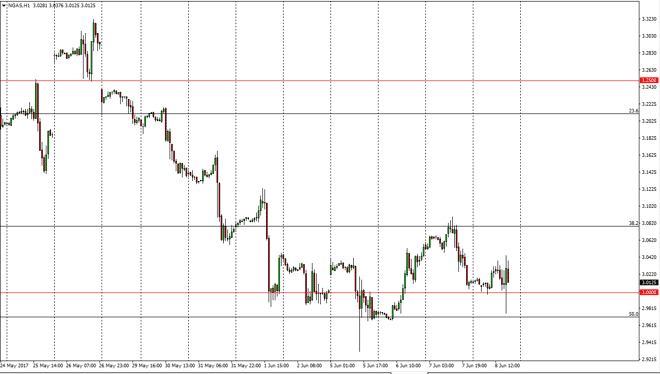

Natural Gas Price Forecast June 9, 2017, Technical Analysis

Updated: Jun 9, 2017, 04:22 GMT+00:00

Natural gas markets had a volatile session on Thursday, initially tried to rally, and then breaking down below the $3 level. However, we found support at

Natural gas markets had a volatile session on Thursday, initially tried to rally, and then breaking down below the $3 level. However, we found support at the $2.97 level again and then bounced enough to break back above the $3 handle. It looks as if we are trying to consolidate in this area, which is essentially looking very likely the $3.08 level above will continue to offer resistance. I believe that an exhaustive candle above after short-term rally might be and I selling opportunity as natural gas markets continue to struggle. Beyond that, crude oil markets are falling apart so I think it’s only a matter of time before the sellers come back into the market and push even lower.

A breakdown is coming?

I believe that a breakdown could be coming, but it needs to build up a bit of momentum building to get going. If we can break down to a fresh, new low, I think that the market then goes down to the $2.75 level under that. I don’t have any interest in buying, least not until we can clear the $3.12 level, at that point I think the market would probably go looking for the $3.25 level. Ultimately, I believe in the downtrend not only due to the seasonality of the situation, but the simple lack of demand for energy in general. The natural gas markets continue to be very volatile, but longer-term charts look likely to continue to signal that we may roll over. You would have to be very patient with this move, but it does look as if the sellers are starting to take control of the market yet again as natural gas continues to suffer longer-term in general. Volatility remains high in this market.

NATGAS Video 09.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement