Advertisement

Advertisement

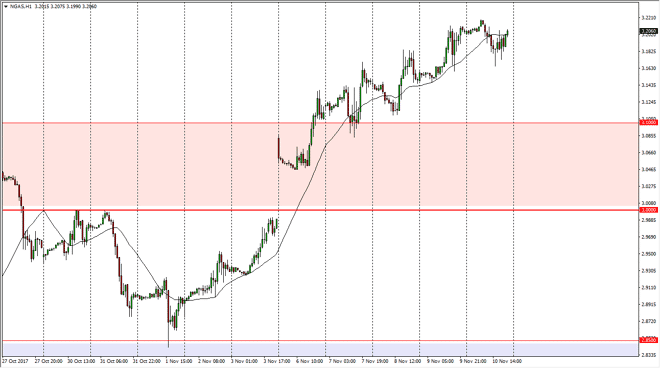

Natural Gas Price Forecast November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:08 GMT+00:00

The natural gas markets initially went sideways during the trading session on Friday, but then dipped towards the $3.15 level. We turned around to form a

The natural gas markets initially went sideways during the trading session on Friday, but then dipped towards the $3.15 level. We turned around to form a move to the upside, and it looks as if the upward momentum continues. I believe that it’s only a matter of time before we go looking towards the $3.20 handle, as we have made such a significant break out this week. It is getting colder in the United States, and this is cyclically when the buyers take over the market, so this move makes perfect sense. I believe that buying the dips will continue to be the best way to go forward, as we see demand rise in the United States. However, this is typically a seasonal effect only, as we have a major bear market and play.

In the foreseeable future, I believe that the $3.10 level should offer a bit of a floor. I also recognize that the market should continue to be very noisy, but then again so goes it in the natural gas pits normally anyways. The market continues to be very noisy, and of course very short-term focused as it typically is, so pay attention to temperatures in the northeastern part of the United States where the largest demand for natural gas typically happens. If we do break down below the $3.10 level, we could go down to fill the gap down to the $3.00 level. However, I suspect that we still have a significant amount of buying about to happen in the market as the recent breakout was an obvious area for the medium-term trend to change. Although natural gas markets look bullish, be advised that they can roll over in the blink of an eye. Typically though, both November and December are very healthy for this market.

NATGAS Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement