Advertisement

Advertisement

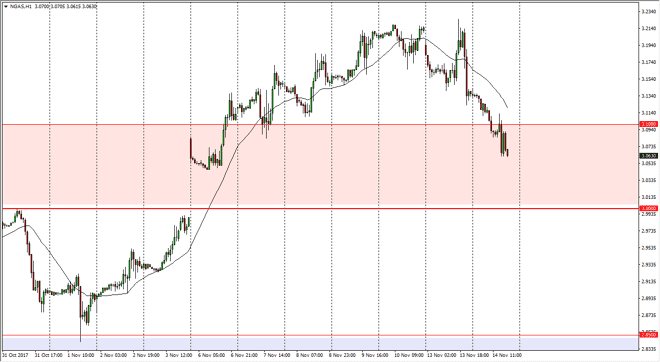

Natural Gas Price Forecast November 15, 2017, Technical Analysis

Updated: Nov 15, 2017, 05:31 GMT+00:00

The natural gas markets fell a bit during the session on Tuesday, slicing through the $3.10 level. By breaking down below there, the market looks like it

The natural gas markets fell a bit during the session on Tuesday, slicing through the $3.10 level. By breaking down below there, the market looks like it is going to try to fall towards the $3 handle underneath which is the beginning of the gap and I think we are trying to fill it. That’s classic technical analysis, and I think that short-term selling is possible, but quite frankly I would be very interested in buying this market near the $3 handle as it had previously been such a massive resistance barrier. By breaking out above there, the market looks likely to continue to go higher, which I think is based upon the seasonality and the demand cycle that we see every year. Ultimately, this could give us a couple of months of bullish pressure, maybe sending this market to the $3.30 level, and then possibly even the $3.57 level after that.

The alternate scenario is a breakdown below the $3 level, and if we do, the market could go to the $2.85 level after that. This market continues to be very choppy and noisy, but quite frankly I think that the bullish pressure underneath continues to mount, as we should continue to see more “buy the dips” mentality. At this coincides with falling temperatures in the northeastern part of the United States, which of course is to be expected. However, by the time January rolls around, it’s likely that the market will roll over again and start focusing on the oversupply that we have seen for some time. Overall, this is a market that you need to be very careful with, because of the liquidity issues that we face at times. Using CFD markets will be the best way to deal with this, as futures markets could get very dangerous at times.

NATGAS Video 15.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement