Advertisement

Advertisement

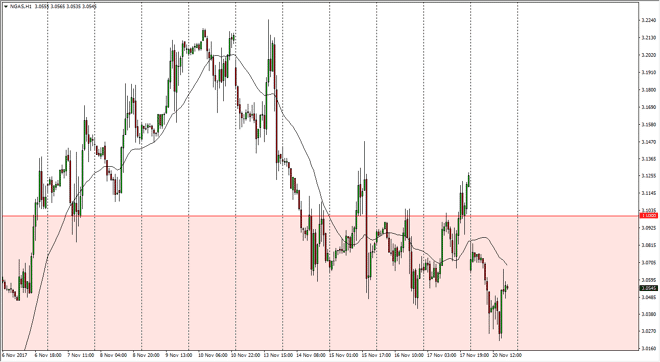

Natural Gas Price Forecast November 21, 2017, Technical Analysis

Updated: Nov 21, 2017, 05:04 GMT+00:00

The natural gas markets gapped lower at the open on Monday, slicing through the $3.10 level without much trouble. We also fell from there, and then

The natural gas markets gapped lower at the open on Monday, slicing through the $3.10 level without much trouble. We also fell from there, and then reached towards the $3.02 level, before bouncing towards the 24-hour exponential moving average, and then rolled over again. It looks as if we are trying to fill the gap that is based around the $3.00 handle, so I think that if we can get some type of bounce from that area, then it’s time to start buying as the seasonality of the natural gas markets dictates higher pricing as colder temperatures in the United States. That of course drives of demand for natural gas, but we are currently trying to fill the technical move to the downside. There isn’t much more left and that move though, so I would anticipate that the buyers will be interested rather soon.

However, if we were to break down below the $2.98 level, that would be an extraordinarily negative sign and could get the market reaching towards the $2.85 level next. Longer-term, the natural gas markets are going to continue to be bearish, but the next couple of months quite often will bring buyers into the situation as demand certainly picks up. However, we have so much in the way of supply longer-term we have no real way of going higher over the longer term. In fact, research I have done recently suggested that perhaps we have 300 years’ worth of natural gas in the ground in the United States alone. The natural gas markets of course are very erratic to say the least, as they are not as liquid as petroleum. Ironically, as we go lower to fill the gap at the $3.00 level, we also need to turn around and bounce to fill the gap that was formed this morning to the downside.

NATGAS Video 21.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement