Advertisement

Advertisement

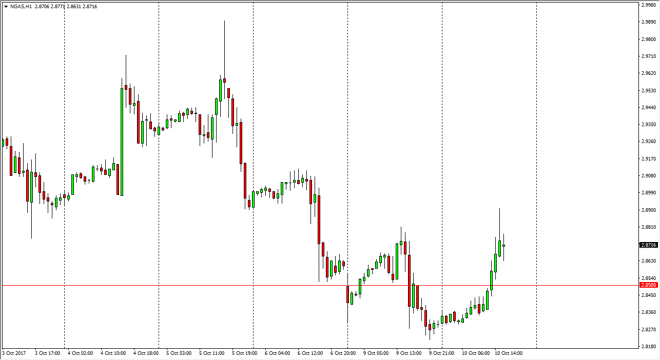

Natural Gas Price Forecast October 11, 2017, Technical Analysis

Updated: Oct 11, 2017, 05:26 GMT+00:00

The natural gas markets rallied during the day on Tuesday, reaching towards the $2.88 level. This is an area that’s been both supportive and resistive on

The natural gas markets rallied during the day on Tuesday, reaching towards the $2.88 level. This is an area that’s been both supportive and resistive on short-term charts, and quite frankly with the massive downtrend that we continue to see in this market and of course the fact that every time that we rally we start seeing sellers has me believing that buying is all but impossible, and that more than likely we can continue the same attitude that we have seen in this market previously, that every time we rally and show the first signs of exhaustion, it’s time to start selling. I think that the market has a massive amount of resistance at the $3.00 level, that extends much higher due to the ability of fracking companies in the United States to turn a profit at that level. With this being the case, it’s very likely that we will continue to see this market get pounded with oversupply in that area.

I still think that there is a significant chance of going down to the $2.75 level, and when I see this type of rally I am looking for an opportunity to start selling. In fact, this is a trade that I have done several times over the last several months, and have profited quite nicely. I believe that we could break down below the $2.75 level, but the $2.50 level underneath there would be much harder to clear. Sellers continue to run this market, and therefore I don’t have any interest in trying to fight that momentum. Given enough time, it’s likely that the market will find itself continually range bound between the $2.75 level and the $3.10 level. This is a market that continues to offer plenty of opportunities, if you are patient enough to take advantage of them.

NATGAS Video 11.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement