Advertisement

Advertisement

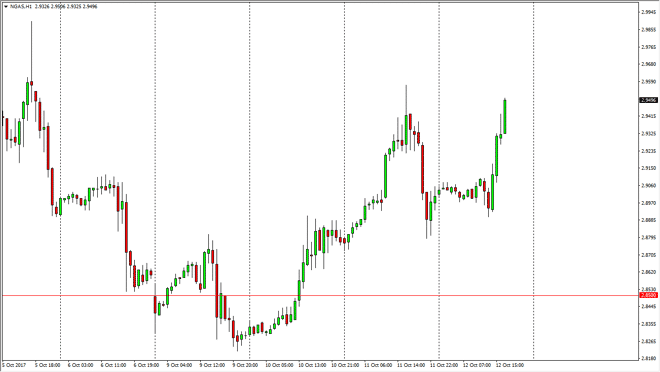

Natural Gas Price Forecast October 13, 2017, Technical Analysis

Updated: Oct 13, 2017, 05:42 GMT+00:00

Natural gas markets went sideways initially on Thursday, as we hover around the $2.90 level. We broke out to the upside, and as I record this video, we

Natural gas markets went sideways initially on Thursday, as we hover around the $2.90 level. We broke out to the upside, and as I record this video, we are approaching the $2.97 level. There is a major barrier above at the $3.00 level, as there is an overhang of supply waiting to get on to the market at these levels. This is mainly due to the oversupply issue causing great strain upon fracking companies in the United States, but the $3 level being an area where they start to make money again. Because of this, I’m waiting for exhaustion to start selling this market as it rolls over. I may wait for a shooting star or something like that on the 4-hour charts to get involved again to start selling. I don’t have any interest in buying natural gas, because quite frankly even though we are approaching the colder months in the United States, the reality is that the oversupply is nowhere near being absorbed, and may not be for years.

Patience will be needed

I think the patience will be needed in this market, and suddenly sitting on the sidelines and looking at these rallies as an opportunity to start selling again is the best way going forward. Trying to anticipate the turnaround is always a fool’s game, and one that most often you will lose. By looking for some type of confirmation signal such as a shooting star on the 4-hour chart, then you start to see that the market is running out of momentum, which is exactly what you want to take advantage of. Natural gas is extraordinarily volatile, and it’s not exactly the most liquid market, so being patient and picking the right spot is without a doubt one of the biggest things you can do to protect your trading account. If you can do that, large profits away.

NATGAS Video 13.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement