Advertisement

Advertisement

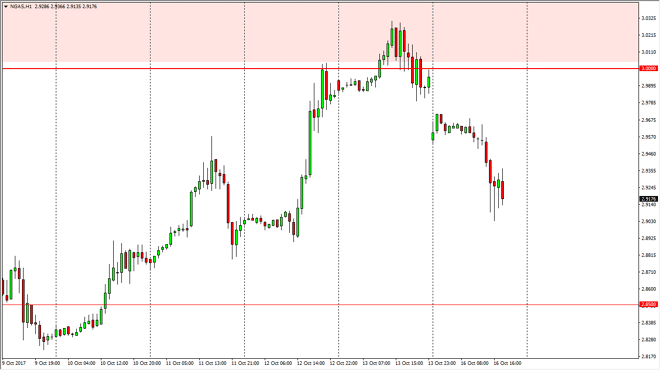

Natural Gas Price Forecast October 17, 2017, Technical Analysis

Updated: Oct 17, 2017, 06:02 GMT+00:00

The natural gas markets gapped lower at the open on Monday, reaching towards the $2.96 level initially, rallying slightly, and then broke down even

The natural gas markets gapped lower at the open on Monday, reaching towards the $2.96 level initially, rallying slightly, and then broke down even further. It looks as if we are trying to find some type of support near the $2.92 level, but I think at best we are going to see a bounce that we can start selling again. I still have a target of $2.85 underneath, and I still believe that there is a massive amount of resistance at the $3.00 level above. That resistance should continue to show selling pressure due to the fact that US fracking companies become profitable above that level, and therefore the massive oversupply of natural gas starts getting offered again every time we get close to that level.

Selling rallies

I continue to sell rallies in this market on signs of exhaustion. That has worked for several months now, with perhaps the one exception being when we broke above the $3.10 level recently. However, the market looks likely to remain somewhat range bound, and therefore I think that selling rallies closer to the $3.00 handle will continue to be the best way to trade this market. I recognize that the $2.85 level underneath is massively supportive, so therefore I’m quick to take profits once we get to that region. I do recognize that we can break down from there though, perhaps reaching towards the $2.75 level after that. I have no interest in buying this market, the oversupply continues to plague pricing power, and at this point, I don’t see being able to buy this market until we clear the $3.10 level significantly, which even doing so last time wasn’t enough to turn the market around longer term. I believe that this market continues to offer plenty of opportunities.

NATGAS Video 17.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement