Advertisement

Advertisement

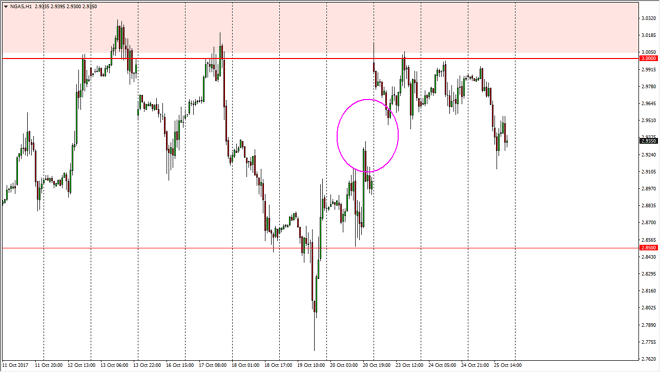

Natural Gas Price Forecast October 26, 2017, Technical Analysis

Updated: Oct 26, 2017, 04:36 GMT+00:00

The natural gas markets fell during the trading session on Wednesday, as the $3.00 level continues to be far too resistive to continue the uptrend. There

The natural gas markets fell during the trading session on Wednesday, as the $3.00 level continues to be far too resistive to continue the uptrend. There are plenty of opportunities to short this market over the longer term, and I believe that above the $3.00 level is the most logical place to find resistance due to the oversupply of natural gas markets, especially considering that the US fracking companies become profitable above that level. They are more than willing to flood the market will supply, because quite frankly they are in a world of hurt when it comes to pricing power. Natural gas is so oversupply that I have no scenario in which a willing to buy the natural gas markets, short of a monthly candle closing above the $3.10 level. I don’t expect to see that anytime soon, even with the colder temperatures coming to the United States, because quite frankly the demand will never be able to wipe out the oversupply.

The $2.85 level underneath should continue to be support, so I think that we will probably spend the next several sessions going between the $2.85 level underneath and the $3.10 level above. I think there’s more of a downward proclivity to this market, so I am looking for selling opportunities only. If we do break down below the $2.85 level, the market probably goes down to the $2.75 level or nearby, but I believe that selling rallies will be the easiest way to trade the market, instead of trying to sell some type of major breakdown. Ultimately, this market remains volatile, but negative. I think that futures markets are fine for this market, because of the overall negative attitude been so strong. While typically I will use CFD markets for volatile markets, this is an exception as it has been so one-way.

NATGAS Video 26.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement