Advertisement

Advertisement

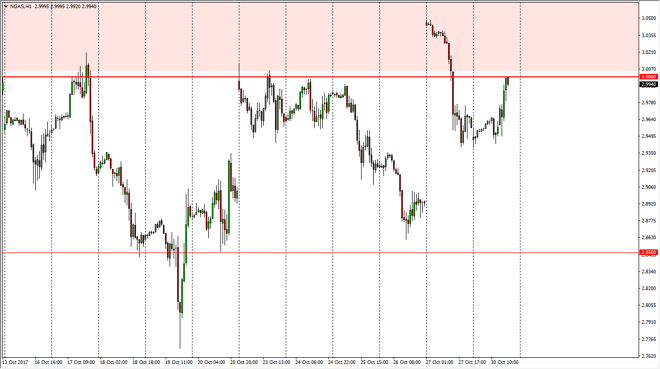

Natural Gas Price Forecast October 31, 2017, Technical Analysis

Updated: Oct 31, 2017, 05:22 GMT+00:00

Natural gas markets rallied initially on Monday, slamming into the vinyl $3.00 level. That’s an area that continues to be a vital interest, and of course

Natural gas markets rallied initially on Monday, slamming into the vinyl $3.00 level. That’s an area that continues to be a vital interest, and of course importance to the market in general. I believe that there is a massive amount of resistance above the $3.00 handle extending towards the $3.10 level after that. This is mainly due to the oversupply of natural gas in general, and US fracking companies being more than willing to flood the market with supply as they become profitable again. It’s very difficult to be profitable in a commodity that is so oversupplied, so it’s likely that this will continue to be the case. I see no potential to chew through the oversupply of natural gas, so I think this is going to continue to be the theme in general, selling on every time we get too expensive.

Don’t necessarily like buying natural gas, but I do recognize that the $2.85 level looks to be rather supportive, so if you are comfortable range bound trading, you could be a buyer down there. I think we are stuck in a trading range for some time, as the cold temperatures in the United States will boost a bit of demand, but at the same time the oversupply is so bad that we can barely find storage space for the natural gas that we do have. Ultimately, I believe longer-term the market will continue to face bearish pressure, and this could be one of my favorite markets going into the next year. The range has been so determined that it’s difficult to make money trading options now, because the volatility is all but dead for the longer-term move. That being said, I am perfectly comfortable going into the futures markets.

NATGAS Video 31.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement