Advertisement

Advertisement

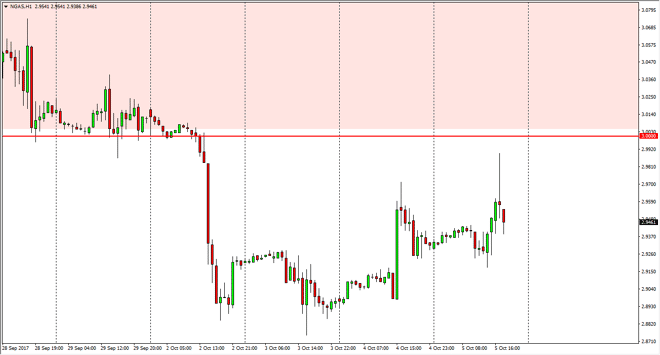

Natural Gas Price Forecast October 6, 2017, Technical Analysis

Updated: Oct 6, 2017, 06:05 GMT+00:00

Natural gas markets went sideways initially on Thursday, but then rallied rather significantly as natural gas inventories were smaller than anticipated.

Natural gas markets went sideways initially on Thursday, but then rallied rather significantly as natural gas inventories were smaller than anticipated. The $3 level above offered resistance, but that isn’t anything new. The fracking companies in the United States are profitable above the $3 level on the whole, so there is a massive amount of supply in that region. By forming a massive shooting star on the hourly chart, it suggests that the market is going to roll over again. I think that we go looking for lower levels, but there is a lot of noise between here and the $2.90 level. I think that if we can break down below there, the market should then go to the $2.88 level, and possibly even lower than that. I think the rallies are to be sold, but that has been the way I’ve been trading this market for some time. This latest shooting star just below the $3 level is very obvious for me as a shorting opportunity.

If we were to break above the $3 level, the market should then find plenty of resistance as well, extending too much higher levels, perhaps to the $3.10 level. I don’t have any interest in trying to buy this market, and the higher we go, the more likely I am to start shorting. Ultimately, this is a market that is very volatile, so that should be kept in mind but certainly we have an oversupply that will continue to cause massive issues for pricing, and that gives you the opportunity to take advantage of what seems to be a massive warning. I think that the markets will eventually go looking towards the $2.75 level underneath, but it’s going to be very noisy on the way back down there.

NATGAS Video 06.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement